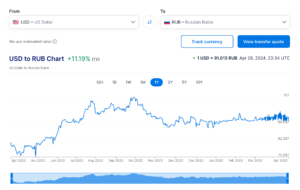

I’m hardly an expert in foreign currency exchange, but something odd seems to be happening in the Russian Ruble-U.S. Dollar exchange rate.

Obviously, the ruble has lost value because of the extensive sanctions and cutoff from SWIFT following Russia’s launch of its illegal war of territorial aggression against Ukraine. For most of the last year, the exchange rate has bounced from a high of 75 rubles to the dollar to a low of just over 100 rubles to the dollar.

However, in the last month, the ruble-dollar exchange rate has traded within an extremely narrow band between just over 90 and just over 94 rubles to the dollar.

That’s a pretty unusual, and pretty narrow, band to be trading in. The question is who, or what, is maintaining that band. Russia could be intervening to make sure the ruble doesn’t go too much above 94, but it wouldn’t make sense for them (if they’re trying to defend the currency) to be sellers on the other side when the ruble appreciates to 90 or less per dollar. Could it be China, trying to move some of the rubles taken in bilateral trade, or some institutional investor somehow stuck with rubles for two two years, unloading them whenever it hits that peg?

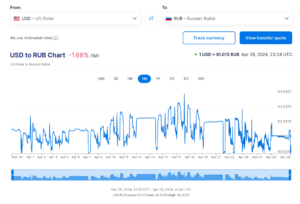

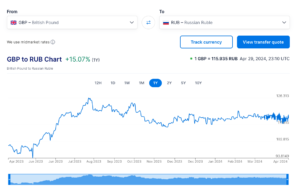

But it’s not just the dollar! We see the same thing with the Pound:

And the Euro:

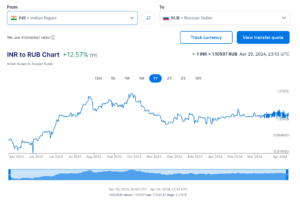

It even seems true of two of Russia’s remaining big trading partners. The Indian rupee:

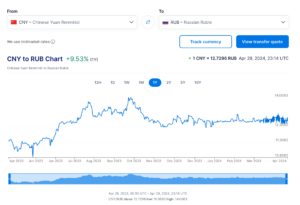

The Chinese Renminbi/Yuan:

All seem to be trading within very narrow, oscillating bands.

Is it a data artifact? Other currency exchange sites don’t show quite as obvious oscillation, but all do show trading within that narrow band.

I don’t know what to make of it. I don’t know enough to hazard any more educated guesses than that. But someone seems to be manipulating ruble exchange rates, and I’m not sure why.

If you have any ideas, feel free to share them below.

Tags: China, currency, Economics, Euro, foreign currency, India, Pound Sterling, ruble, Russia, Russo-Ukrainian War

When you see wild price fluctuations in a market, it indicates difficulty locating the market-clearing price—where supply and demand equilibrate.

Here, demand for rubles seems to be flat because entrepreneurs have sussed out the ruble’s exchange rate and everyone has taken offsetting short/long positions against it. There seems to be very little up/down risk attributed to holding rubles.

I strongly suspect that currency traders have underpriced ruble risk. To my mind, the willingness of China and Iran to accept rubles in exchange for military goods is what gives it comparative stability.

If Iran or China were to alter their monetary policy, Iran by demanding more money for a barrel of oil or China by emphasizing domestic consumption or increased military spending over favoring export activity, the ruble would fall precipitously.

For now, Russia is helped by China and Iran. Tomorrow, Iran may suffer a catastrophic military reversal and China may enter a deep recession. Either scenario leads to a loss of support for the ruble with no other sovereign power willing and able to fill their role.

Long term, the ruble will continue to depreciate against all other widely traded currencies.

ForEx rates are substantially controlled by relative interest rates. Russian Central Bank Governor Elvira Nabiullina is one of the best in the world and she enjoys the full confidence of Vladimir Putin and the Russian government. She is manipulating interest rates to collar USD/RUB.

Nabiullina has pushed the Russian 10 year bond yield from 11.75% to 14.4% over the last three months as the 10 year UST yield has risen from 4.0% to 4.6%. This collared USD/RUB and has suppressed internal inflation which is the main problem in a Russian economy which has been retooled for all out war production.

“She is manipulating interest rates to collar USD/RUB.”

And just like that, the Euro, Pound, Rupee and Renminbi followed suit.

The ruble has flatlined because there is no upside to holding it and China/Iran have put a floor in beneath it.

“And just like that, the Euro, Pound, Rupee and Renminbi followed suit.”

EUR/USD, GBP/USD, and USD/INR are all showing normal, minor fluctuations over the last 2 to 3 months, based on relative interest rates and their governments’ various forms of ForEx meddling. USD/JPY is the only significant currency pair showing recent convulsions, due to speculation that the Bank of Japan is planning a ForEx intervention.

CNY/USD is a special case due to intense ForEx management by the Peoples’ Bank of China. They have been using their huge dollar reserves to periodically spike CNY/USD from 0.138 to 0.141 during the last month, a 2.2% bump. This keeps the baseline Renminbi rate where the PBC wants it.

The Russian Ministry of Finance uses auction operations to manage the OFZ benchmark 10 year bond interest rates to keep inflation under control. This has a side effect of managing USD/RUB.

“CNY/USD is a special case due to intense ForEx management by the Peoples’ Bank of China.”

Do you are saying that China has put a floor under the ruble? Whoda thunk it?

“CNY/USD is a special case due to intense ForEx management by the Peoples’ Bank of China.”

So you are saying that China has put a floor under the ruble? Whoda thunk it?

ForEx rates are substantially controlled by relative interest rates.

I did a paper on the Dollar / Deutsche Mark exchange rate for a Stats class back in college, and that’s precisely what I had for a result.

“So you are saying that China has put a floor under the ruble? Whoda thunk it?”

The PBC can put a floor under the Yuan Renminbi, but not the Russian Ruble. The Yuan Renminbi was pegged to the US Dollar from 1997 until 2005, when maintaining the peg became too expensive for the PBC. The peg had also begun to hurt China’s economic competitiveness. Since 2005, the PBC has attempted to manipulate CNY/USD through regular, massive ForEx transactions.

Economic warfare between the Federal Reserve and the PBC since 2005 have reduced the ability of the PBC to manipulate the Yuan Renminbi exchange rates, but they can still adjust the value of the Yuan Renminbi at a cost commensurate with the magnitude of the valuation adjustment desired. The PBC minimizes the cost of these Yuan Renminbi adjustments by staging short, sharp ‘interventions’.

Russian Central Bank Governor Elvira Nabiullina has a classical perspective on trade and currency values, so she doesn’t stage ‘interventions’. We don’t know, however, what use she is making of Russia’s substantial gold reserves. There is widespread suspicion that Russia’s gold reserves are being used to pay for imports from China, Iran, and North Korea.

Capital controls are no small part. No one can make a big bet on the rouble because money cannot flow freely. Even if I wanted to short the rouble, I couldn’t cover my short due to inadequate supply. Inside Russia, foreign currency cannot flow freely between private individuals. There’s not much action in the rouble that isn’t state controlled.

At this point, the rouble is really a polite fiction. Russia will henceforth use the currency of their new overlords in Beijing. The Russian economy turned out to be more dependent on the world than vice-versa. Xi’s gonna drive a hard bargain.