In The Before-Time, The Long Long Ago, prior to The Great Dot Com Bubble Bust, newspapers (remember those?) were filled with reports of day-traders, ordinary people who quit their day jobs to trade stocks. And what do you know! A whole bunch of them made money doing that! They must have been geniuses!

Few paused to test an alternative theory: They just happened to be riding the tail end of one of the greatest stock bubbles in history. It’s easy to pick stock market winners when there are lots of winners around.

Then the bust hit, and a whole lot of geniuses turned out to not be so smart after all, especially those who had backed such companies as Flooz and WorldCom.

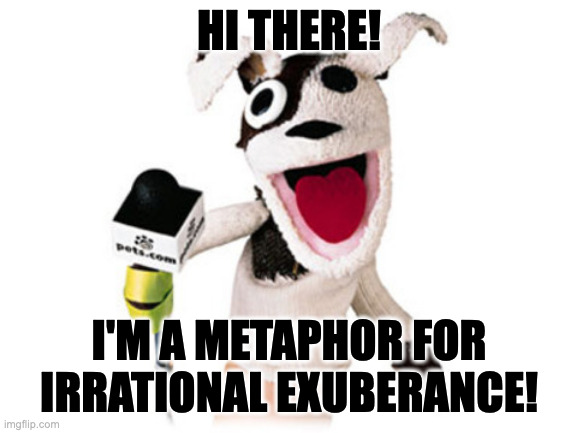

Thanks in large measure to the SUPERgenius economic management of the Biden Administration, the world is now exiting an era of historically cheap money and entering a period of rising interest rates. A whole lot of business models that seemed to make sense during an era of cheap credit are going to look as retroactively foolish as Pets.com.

Example the first: Vice Media is looking for a buyer.

Vice will be mounting a new round of cost-cutting to try to stretch out its solvency while it searches for some sucker to buy it.

Vice does not make money. It will never make money. It just wants a series of Sugar Daddies willing to pump money into it forever to keep its overpaid, underperforming staff paid.

Snip.

The article says that they can only estimate what Vice is worth. They guess it’s worth, maybe, “at least one billion.” (And they owe $1.1 billion in debt?)

It was valued at $5.7 billion just a few years ago.

Ace of Spades also posted this Ryan Long video that I’m absolutely stealing:

As for the next media outlets to close, well, I’ve got to think any Bulwarkesque outlets whose entire raison d’être is subsidized Trump-hating is going to look like a luxury good during the Biden Recession.

And Crunchbase keeps a running list of tech layoffs.

Another sign of the serious straits people find themselves in: Consumers are maxing out their credit cards.

High debt, high inflation and high interest rates are all recipes for disaster. And as those pools of liquidity dry up as cheap capital recedes, all the stranded starfish that so briefly thrived will find that they have no place to hide in the Biden Recession.

Allusion in headline:

Tags: Ace of Spades, Biden Recession, Democrats, Economics, inflation, interest rates, Media Watch, Ryan Long, Vice News, video

When you mentioned stranded starfish, I thought for sure you were going to post Peter Gabriel’s “Here Comes The Flood”. Thanks for reminding me about Jane Siberry, though.

Just paid off the remaining $144 credit card balance. No car loan. Only $96K on mortgages on two houses (one of which has only small HELOC balance). My goal is to get debt free for the first time since my first gas credit card at 21.

It is a nod to Gabriel’s “Here Comes To Flood” (a great song), but the problem with embedding it is that the metaphor goes the wrong way. It isn’t a flood, but a drought (of cheap credit) that is going to strand so many high and dry…

One of the things that we’d all be wise to remember is that we’re in essentially unexplored territory, here. The left is operating as though we were in a post-scarcity economy, and I think that to a degree, they might be somewhat correct. I honestly cannot understand why the underlying conditions haven’t caught up to them, unless they are at least partially correct about that thesis.

Where all this ends is going to be a lot different than anyone thinks. The thing that just yikes me is that these morons completely fail to understand that the enablers for all this, the cheap energy and fertilizer? They’re key and essential to the post-scarcity thing. Cut the legs out from under, and bam, down goes the edifice we’ve built. And, they’re steadily down there at the base of things, chopping away. Right now, most of our food inputs come from about 1.312% of the population. What, do you suppose, will have to happen to enable all that “organic farming” with “natural fertilizer”? How many will have to go back to farming? How much is that going to cost? Will the welfare that supports the urban poor even be feasible, under those conditions?

We are governed by idiots and ignoramuses, people who have no idea at all how things actually work, out in the real world. They’re about to find out what happens when you break everything, and I don’t think they’re gonna like it.

I’m here via Instapundit. Thank you for the Jane Siberry reference!

Kirk, the reason we haven’t had to pay the piper is the US is THE reserve currency There are other more complex ones demography, a surfeit of producers but by and large, the petro dollar/reserve currency/Pax Ameircana is #1

Back to the mud…

[…] Hispanics will always vote for Democrats, assuming that housing prices will always go up and that credit will always be cheap are categorical mistakes that the market will eventually punish you for making, and the companies […]

[…] The Great Leveler is coming, Mimi… […]

[…] virtue-signaling luxury goods as long as your core business is strong. But with rising interest rates, Biden Inflation, the Biden Recession and the gale winds of deglobalization, taking your eye off […]