Over on Big Journalism, Joel Pollack makes a point I’ve been emphasizing in my EuroDoom roundups: Austerity hasn’t failed in Europe, it hasn’t even been tried:

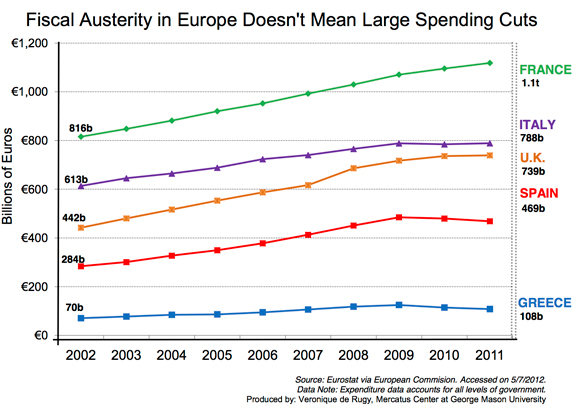

The media insists on describing recent election results in Europe as a blow to “austerity,” when in fact Europe’s recent policies are anything but. Government spending has continued to rise across much of Europe, and even those countries that have made small cuts have not reduced government spending to pre-recession levels.

He in turn references this Veronique de Rugy piece at NRO (though the link is broken, so I had to go Googling) which also gives us this handy chart:

None of these “austerity” measures eliminated deficit spending, and none addressed the issue that’s driving all of Europe (and us) bankrupt, namely unwillingness to carry out structural reforms of the welfare state. The few tiny reforms that have been undertaken have been, as NRO’s Michael Tanner notes, ridiculously timid, and even those have been heavily weighted in future years. “So far, European governments haven’t even been willing to take a penknife to the welfare state, let alone an axe.” Plus a huge round of tax hikes:

It should come as no surprise that all those new taxes, combined with a lack of spending restraint, has threatened to throw Europe back into a double-dip recession. Is it any wonder that French, Greek, and British voters were anxious to “throw the bums out”?

Wait, this sounds familiar. Tax hikes on the rich accompanied by vague promises of future spending restraint, while refusing to restructure entitlement programs. That sounds a lot like . . . Barack Obama.

Actual austerity would mean (at a minimum) reducing spending to the amount of money actually taken in. As best I can tell, none of the PIIGS, or France, or the UK has undertaken such real austerity. That “severe” Greek austerity that just caused a change in government? It reduced Greece’s official deficit spending from 9.0% of GDP to 7.5% of GDP. They didn’t even want Greece to stop digging a hole, they just wanted them to dig more slowly.

I suspect that some 20-30 years hence, this mania for deficit spending will be seen as absolute madness, with future generations unable to fathom how politicians were so resolute in destroying their countries economies in order to maintain the welfare state, a folly for the ages. Hyperinflation is probably already baked into the Greek pie for its inevitable exit from the Eurozone, the only question is whether it will be Argentina 1999-2002 style hyperinflation, or Weimer Germany 1919-1923 style hyprinflation, and how much of Europe (and the rest of the world) will follow in their tracks.