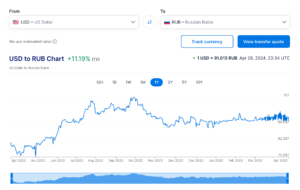

I’m hardly an expert in foreign currency exchange, but something odd seems to be happening in the Russian Ruble-U.S. Dollar exchange rate.

Obviously, the ruble has lost value because of the extensive sanctions and cutoff from SWIFT following Russia’s launch of its illegal war of territorial aggression against Ukraine. For most of the last year, the exchange rate has bounced from a high of 75 rubles to the dollar to a low of just over 100 rubles to the dollar.

However, in the last month, the ruble-dollar exchange rate has traded within an extremely narrow band between just over 90 and just over 94 rubles to the dollar.

That’s a pretty unusual, and pretty narrow, band to be trading in. The question is who, or what, is maintaining that band. Russia could be intervening to make sure the ruble doesn’t go too much above 94, but it wouldn’t make sense for them (if they’re trying to defend the currency) to be sellers on the other side when the ruble appreciates to 90 or less per dollar. Could it be China, trying to move some of the rubles taken in bilateral trade, or some institutional investor somehow stuck with rubles for two two years, unloading them whenever it hits that peg?

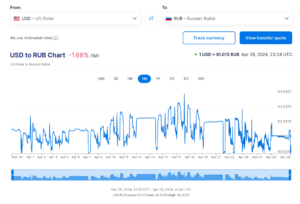

But it’s not just the dollar! We see the same thing with the Pound:

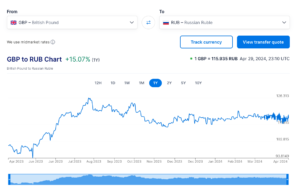

And the Euro:

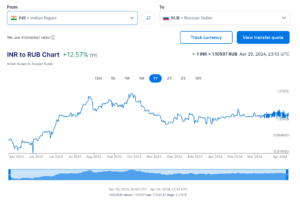

It even seems true of two of Russia’s remaining big trading partners. The Indian rupee:

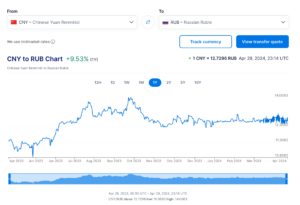

The Chinese Renminbi/Yuan:

All seem to be trading within very narrow, oscillating bands.

Is it a data artifact? Other currency exchange sites don’t show quite as obvious oscillation, but all do show trading within that narrow band.

I don’t know what to make of it. I don’t know enough to hazard any more educated guesses than that. But someone seems to be manipulating ruble exchange rates, and I’m not sure why.

If you have any ideas, feel free to share them below.