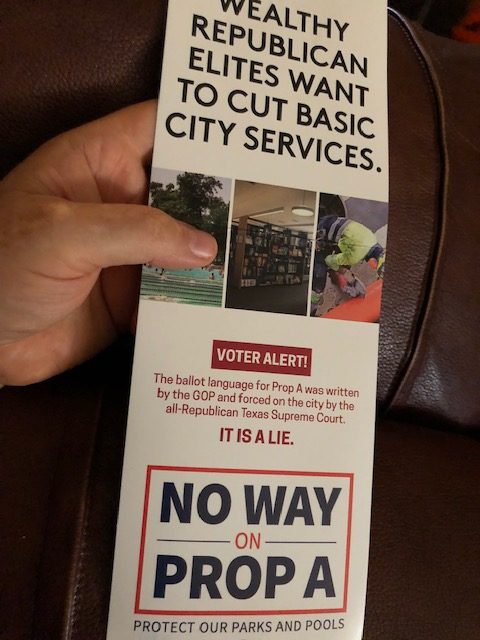

With plenty of out-of-state money (including half a million from George Soros), Austin Justice Coalition and their allies managed to deliver a resounding defeat to Proposition A. There was a lot of signage against Prop A, and readers in Austin say they received anti-Prop A flyers. Here’s an example:

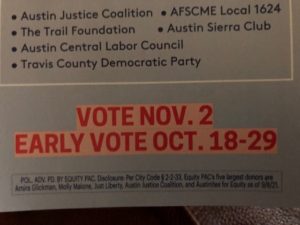

And here’s a closeup of who funded it:

There’s two places on the flyer it says it was partially funded by the Austin Justice Coalition.

Tiny problem: The Austin Justice Coalition is a 501(c)(3) organization last time I checked, and 501(c)(3) have very specific prohibitions against engaging in certain types of political activity and advertising.

(You might be wondering: Is that’s the case, how could SaveAustinNow legally campaign for Proposition A? Easy: They’re a 501(c)(4) organization, the rules for which are different.)

Did Austin Justice Coalition violate federal law? Maybe. Austin Justice Coalition briefly lost their tax exempt for failing to proper documentation. (It’s easier to search for information on them when you have their tax ID number: EIN 81-3138826.) But I’m not a lawyer, and the IRS statute language specifically mentions that 501(c)(3) organizations can’t campaign for or against candidates. I am unsure whether this prohibition extends to campaigning for or against ballot propositions.

Perhaps an expert in campaign finance law can shed some light on the issue…

(Hat tip: Blog commenter Clinton.)