Time for another LinkSwarm:

And remember that your taxes are due tomorrow…

Time for another LinkSwarm:

And remember that your taxes are due tomorrow…

Time for another LinkSwarm, sweeping up all the news that was happening while I was churning out Texas primary news:

“The exchanges are based on layers upon layers of bad software, run by shady characters,” he writes. “The Bitcoin masses, judging by their behavior on forums, have no actual interest in science, technology or even objective reality when it interferes with their market position. They believe that holding a Bitcoin somehow makes them an active participant in a bold new future, even as they passively get fleeced in the bolder current present.”

The indomitable Walter Russell Mead has been traipsing around Europe, and has much of interest to report from various countries there regarding the continuing slow-motion Euro crisis.

The Italians? Not happy.

The Italians feel caught in a cruel trap; the euro is killing them but they don’t see any alternative. When a German visitor gave the conventional Berlin view (the southern countries got themselves into trouble by bad policy, and austerity is the only way out; budget discipline and cutting labor costs are the only way Italy can once again prosper), a roomful of Italians practically jumped on the table to denounce his approach.

The Italian position is basically this: it’s crazy to blame Italy or the other southern countries (except Greece, which nobody seems to like very much) for the euromess; Germany played a huge role in designing the poorly functioning euro system in the first place and remains its chief beneficiary. When German banks lent billions to Spanish real estate developers and hoovered up the bonds of southern countries, where were the German bank regulators? German politicians, say the Italians, don’t want to admit to their voters that incompetent German bankers and incompetent German bank regulators wrecked the German financial system by making stupid loans worth hundreds of billions of euros. In a “normal” world, German politicians would have to go to their taxpayers to fund a huge bailout of insolvent German banks thanks to their cretinous euro-lending. Pain would be more equitably distributed between borrowers and lenders.

From an Italian point of view, much of Europe’s austerity isn’t the result of German moral principles; Italians think that a cynical absence of moral principles led the German political class to scapegoat garlic-eating foreigners in a desperate attempt to prevent the voters from noticing just how recklessly incompetent the German elite really is. Germany is using the mechanisms of the euro to force southern governments to bail out German (and French and other northern) banks at immense social pain and economic cost. The Italians, even sensible and moderate ones who want to cooperate with Europe, totally reject the logical and moral foundations of the German approach to the crisis, and they feel zero gratitude or obligation to make life easier for Germany as the drama unfolds.

The French? Not happy.

In France, the people I spoke with worried about the rise of the National Front. According to some polls the ultra-right could emerge as the biggest party in France in the next round of regional and European elections. The French Socialists under the increasingly unpopular President Hollande don’t seem to have much idea about how to move forward; their most popular politician at the moment is a Minister of the Interior who is trying to compete with the National Front for the anti-immigrant vote by breaking up encampments of Roma and denouncing them as immigrants who don’t want to assimilate.

Also they, and the rest of Europe, seriously misunderstand the Tea Party:

One of the reasons Europeans are so fearful of the Tea Party is that they assume that because it is right wing and populist it is like the National Front in France or Golden Dawn in Greece. Today’s small government American Tea Partiers are much farther from Huey Long and Father Coughlin in their political views than some European right wingers are from the darker demagogues of Europe’s bloody past, and until the European establishments understand this, they will likely continue to misjudge the state of American politics.

The Germans? It’s complicated.

There are Germans who sympathize with the Italian critique of EU austerity policy, but Germans on the whole seem to feel that in pushing a tough reform agenda in Europe, and linking further payments and bailouts to that reform agenda, they are doing their neighbors a favor. They sincerely believe that their own relatively strong economic performance is the result of their willingness to accept some liberalizing reforms coupled with a commitment to fiscal prudence. They think that by exporting this model they are helping other European countries on the path to lasting prosperity, and they believe that with some patience, the other European countries will soon begin to experience the benefits of German-style economic reform.

Europe, of course, has a very unhappy history with things labeled “German-style.”

Mead feels that Europe is rich enough to continue subsidizing it’s Euro-folly for the immediate future, but it comes at a cost:

The bitter public feelings generated by the euro crisis and its long, painful aftermath are still working their slow and ugly way through the European political system. In country after country we are seeing steady gains by political movements that bear a superficial resemblance to the American Tea Party, but in fact flirt much more with the kind of dangerous nationalist and chauvinist ideas that have proven so destructive in Europe’s past.

It’s a sobering, moderately lengthy read, and I commend all of it to your attention.

You may have heard that France’s new socialist President Francois Hollande wants to tax anyone earning more than a million francs a year at 75%.

One of the people that France’s high tax rates have already driven out is supermodel Laetitia Casta.

So remember liberals: When you hike taxes to the stratosphere, you’re driving out this:

Won’t someone please think of the supermodels?

Chances are good that Europe’s interesting Eurozone times are about to get more interesting still with elections scheduled across the continent today, including those in France and Greece. So what does all this mean? Well, for one thing, the French socialist candidate (who has a good chance to kick Nicolas Sarkozy out of office) wants to renegotiate the fiscal discipline treaty. Perhaps even a socialist can tell a rotting fish when he smells one. And in Greece, the anti-bailout parties are expected to make dramatic gains at the expense of the “center-right” New Democracy (Tweedledee) and “center-left” Pasok (Tweedledum) parties who managed to bring Greece to this lovely pass in the first place.

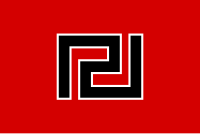

Opposing Tweedledee and Tweedledum are a motley collection of small parties, including the Neo-Nazi Golden Dawn. Now in Europe, everyone to the right of the Christian Democrats seems to be labeled a “neo-Nazi,” be they libertarians, Geert Wilders, or the British National Party, but Golden Dawn appears to be the real thing. Take a look at their flag:

The overall color scheme seems vaguely familiar. Where have I seen that before? Let me think…

Of course, Golden Dawn is unlikely to gain enough votes to be a real player in the Greek parliament, so we may be denied the irony of seeing neo-Nazis oppose Greece’s German overlords.

There are also elections in Serbia and Armenia, lower level elections in Italy, and in Germany, regional elections in Schleswig-Holstein. While “regional elections in Schleswig-Holstein” must be almost as exciting a topic to American readers as enhanced rescission authority, it might go a long way toward determining whether Angela Merkel will continue in her role as Europe’s Sugar Momma Dominatrix.

Could the ruling parties lose everywhere? Well, since the ruing parties have collectively lost every single election since 2009, yeah. Now, whether the Eurocratic elite are will to let a little thing like “democracy” derail their dreams for an integrated Europe remains to be seen.

Other Eurozone news from the last month or so:

With government debt expected to hit 80% of GDP by the end of 2012, Spain has become like a family with a big mortgage where the primary breadwinner has lost his job. Unless they find a way to increase their income, they are going to go bankrupt. It is only a matter of time.

If people want to know what life looks like in the “Prohibitive Range” of the Laffer Curve, all they have to do is to visit Athens. Greece is literally falling apart. Unfortunately, by raising taxes, Spain is making exactly the same mistake that the Greeks made.

France’s credit rating, that is. “Standard & Poor’s has downgraded France’s credit rating, French TV reported Friday, while several euro zone countries face the same fate later in the day, according to reports.” Maybe because that “strict” 2012 budget France passed still had a budget deficit of 4.5% of GDP, despite the EU having a “limit” (in much the same way the Professional Wrestling has a “limit” on fouls) of 3.0%.

That would be the second largest economy in the Eurozone behind Germany, and the fifth largest in the world.

And the U.S. Federal Government’s 2012 budget deficit is running at about 6.9% of GDP…

It didn’t take long for cracks to start appearing among national politicians who are not nearly so sanguine over the prospect of Anschluss II as their counterparts in Brussels.

The French people are not wild about it either. But French politicians only pay slightly more attention to the French people than they do to the American government, which is to say: precious little.

The Portuguese threaten nuclear default.

Did the announcement calm markets elsewhere? Not so much:

Some of the world’s most powerful investment banks were downgraded by ratings agency Fitch as Germany’s cherished European fiscal compact appeared to be unraveling. The banks that were downgraded [Wednesday] night include US banks Bank of America and Goldman Sachs, Barclays and France’s BNP Paribas. Switzerland’s Credit Suisse and Germany’s Deutsche Bank were also cut.

Even France is in danger of a downgrade.

Of course, all this supposes that the new EuroPact will actually accomplish something. Fitch Ratings is not so sure. After warning of rating downgrades on “Belgium, Cyprus, Ireland, Italy, Slovenia and Spain,” they come to the bracing conclusion that “a ‘comprehensive solution’ to the eurozone crisis is technically and politically beyond reach.”

And now for the section of the roundup in which I quote whopping large chunks of Ambrose Evans-Pritchard on the whole thing.

First, the EU would like the UK to throw more money into the black hole. The UK is telling them to get stuffed:

Euro rage is reaching new heights over Britain’s latest outrage.

Our refusal to pony up a further €31bn we cannot afford, to prop up a monetary union that was created against our wishes and better judgment, and with the malevolent purpose of accelerating the great leap forward to a European state that is inherently undemocratic.

It is being presented as treachery, Anglo-Saxon perfidy, and the naked pursuit of national self-interest.

Let me just point out:

1) The UK never agreed to such a commitment in the first place. The line was written into the December 9 summit communiqué in an attempt to bounce Britain into handing over the money.

2) The UK does not consider the rescue machinery to be remotely credible as constructed.

3) The eurozone has the means to tackle its own debt crisis, if it is willing to use them. These include fiscal pooling and the mobilisation of the ECB.

As eurozone politicians never tire of reminding us, their aggregate debt levels are lower than those of the UK, US, or Japan. They are right. So get on with it and stop begging.

Euroland is of course entitled not to deploy eurobonds or the ECB if these mean a) a breach of the German constitution b) violate the ECB’s mandate. But that is entirely their choice. Both the Grundgesetz and the ECB mandate can be changed.

It was EMU members who created this dysfunctional currency. They are now trying to shift the consequences of their error onto others rather than taking the minimum steps necessary to fix the problem at root.

Second, his pointing out that the proposed treaty actually accomplishes very little:

The leaders of France and Germany have more or less bulldozed Britain out of the European Union for the sake of a treaty that offers absolutely no solution to the crisis at hand, or indeed any future crisis. It is EU institutional chair shuffling at its worst, with venom for good measure.

[snip]

And what for? All this upheaval for a mess of pottage, a flim-flam treaty? The deal is not a “lousy compromise”, said Angela Merkel. Well, actually that is exactly what it is for eurozone politicians searching for a breakthrough.

It tarts up the old Stability Pact without changing the substance (although there will be prior vetting of budgets). This “fiscal compact” is not going to make to make the slightest impression on global markets, and they are the judges who matter in this trial by fire.

Yes, there is more discipline for fiscal sinners, but without any transforming help. Even the old “Marshall Plan” of the July summit has bitten the dust.

There is no shared debt issuance, no fiscal transfers, no move to an EU Treasury, no banking licence for the ESM rescue fund, and no change in the mandate of the European Central Bank.

In short, there is no breakthrough of any kind that will convince Asian investors that this monetary union has viable governance or even a future.

Germany has kept the focus exclusively on fiscal deficits even though everybody must understand by now that this crisis was not caused by fiscal deficits (except in the case of Greece). Spain and Ireland were in surplus, and Italy had a primary surplus.

As Sir Mervyn King said last week, the disaster was caused by current account imbalances (Spain’s deficit, and Germany’s surplus), and by capital flows setting off private sector credit booms.

The Treaty proposals evade the core issue.

Ironically, the actual text of the new agreement has all sorts of things (like requiring a Balanced Budget Amendment to national constitutions) that, had it been in place and enforced 15 years ago might have prevented the situation in the first place. But if the nations of Europe had been capable of balancing their budgets, they wouldn’t have needed a Euro-fueled spending spree to keep their welfare states solvent in the first place.

For the PIIGS, growth is neither possible nor enough: “There is at this point no conceivable policy scenario which somehow makes Italy and Greece grow by as much as 2% a year for the next few years.”

Fed says no Euro bailout. But one might wonder at the firmness of their resolve. Especially since the head of the IMF says they need funds from outside the EU. Because who doesn’t love throwing good money after bad?

European bank walks are starting to turn into bank jogs.

Gold prices have plunged since the Euro treaty was announced. A sign the worst has passed? No, quite the opposite: Europe’s banks are selling their gold reserves in an attempt to stay solvent.

Let’s see if I’ve got this straight: EuroZone members, threatened by sovereign default on their bonds, are giving money backed by those same bonds to the IMF, which will use the money to prop up the EuroZone in order to prevent EuroZone countries from defaulting on their bonds. In order to help readers understand the genius of this maneuver, I have slightly altered a graphic from a recent movie to explain the concept:

(Hat tips: Insta, Ace, and The Corner, plus no doubt a few I’ve forgotten.)

Let me see if I can get this straight:

UK Prime Minister David Cameron, objecting to the Deutschland Uber Alles renegotiation of the Maastricht Treaty, is now causing the creation of a new SuperDuper Europe, with Germany reoccupying the Rhineland taking leadership of the whole shebang, finally erasing the rest of the continent’s reluctance at receiving orders from Berlin?

I mean, when even the Europhillic New York Times says that “Twenty years after the Maastricht Treaty, which was designed not just to integrate Europe but to contain the might of a united Germany, Berlin had effectively united Europe under its control,” maybe the citizens of those stodgy old entities we used to call “countries” should consider the possibility that they might may be making a mistake. I am especially surprised that the non-Euro-using generalgouvernement Poland gave in so readily, as their previous experiences with rule from Berlin have been less than exemplary.

But what’s sacrificing the last of your country’s vestigially sovereignty compared to the glorious dream of saving the Euro?

Assuming, of course, that forging this Pact of Steel (including a 500 billion Euro bailout fund) actually saves the Euro, which is a dubious proposition at best. And at least one U.S. general says we should be prepared for civil unrest if Euro ends up exploding anyway.

The irony, of course, is that David Cameron, the wetest Tory Wet PM since Neville Chamberlain, refused to give in to another Eurotreaty British citizens wouldn’t get a chance to vote on less than two months after refusing to allow a vote on the previous EU treaty British citizens were not allowed to vote on. It would be ironic if Cameron actually ended up pulling the UK out of the EU because, in a moment of weakness, he actually exhibited rare and uncharacteristic streaks of firm principle and common sense.

Will the citizens of Europe actually get a chance to vote on this Reich closer European integration? Doubtful. Ireland’s Taoiseach is being “cagey” about a vote. (Translation: Fark no, you peasants won’t get a vote.) I doubt any of his brothers in Europe’s Permanent Ruling Class will feel any less “cagey.”

Through a thousand small steps, from committees and working groups and consultations and emergency decrees, Eurocrats have done their very best to remove power for all important decisions from the hands of the people and entrust it into their own well-greased palms. And also, not so coincidentally, to avoid taking the blame for the ruin their cradle-to-grave welfare states, and the huge and ever-growing debts necessary to pay for them, have made of Europe’s once free nations and productive economies.

Other Eurozone news, some possibly stale and out of date:

For years, Europeans loved to lecture Americans on the both the safety and soundness of the continent’s banking system as opposed to our own, and how their economic system worked so much better than ours. Well, one lesson of the 2011 financial crisis is that many of their banks are probably in worse shape than the US banks were in 2008.

At least our banks’ troubled investments were tied to real estate, which may rebound once our economy improves. Their banks are holding debt tied to some of the world’s least productive, no-growth countries.

Why so underproductive? Most of the evidence points to the failure of the European welfare state.

Europeans loved to lecture Americans on how government-run health-care and cradle-to-grave entitlements provided such safety and comfort for the masses. People supposedly didn’t mind paying higher taxes because it enhanced their standard of living.

Until, of course, it didn’t enhance anything — and Greece, Italy, Spain and Portugal face the collapse of their safety nets because they can’t borrow to pay for them anymore, even as unemployment is rampant. (Meanwhile, France is not far behind.)

“In a direct echo of previous events in Libya, France has formally recoginsed the opposition Syrian National Council and proposed that international troops should protect civilians.”

Meanwhile, those rebels are calling for international air strikes against the Assad regime.

It’s quite possible that the Assad regime could unravel much faster than Moammar Gadhafi’s regime in Libya did, since whole army units have already defected, and Assad is much more isolated from his country’s Sunni majority that Gadhafi was (at least ethnically) from his.