Posts Tagged ‘Greece’

Friday, June 28th, 2013

It’s supposed to hit a 106° in Austin today. Sadly, not all of these links will help you keep your cool…

12 different IRS offices targeted conservatives.

Over 1,100 patients were starved to death at NHS hospitals in the UK. Funny, I don’t remember that being mentioned in the Olympic tribute to how awesome NHS is…

Marco Rubio aide: We need illegal alien amnesty because American workers suck.

Blue collar Americans having trouble finding jobs. I’m sure that has nothing to do with our ruling political elite’s decision to allow unlimited illegal immigration of unskilled workers…

Every Republican voting for amnesty better get ready for a primary challenge.

Obama camapign workers convicted of voter fraud in Indiana. This was for the 2008 Democratic primary, so it will likely be many years before see starting seeing convictions for the Obama campaign’s various 2012 voting fraud efforts…

Noam Chomsky attending the opening of Hezbollah’s “Death to Israel” theme park.

People told me that if I voted for Romney, the U.S. military would start blocking access to liberal news sources. And they were right!

The Atlantic says that Obama “succeeded” in Libya but is failing in Syria. If Benghazi was success, I’d hate to see what failure looks like.

And speaking of Benghazi, Libya just let one of the suspected attackers walk. Thank God we have Obama’s smart, sophisticated diplomacy in the Middle East…

Beer now unaffordable in Greece. And you thought they had riots before…

Second Colorado Democrat faces a recall election over gun control.

Magpul to give away 1,500 30-round magazines just two days before Colorado outlaws them.

By the way, there’s a Facebook page to show support for bringing Magpul to Texas. But most of the rumors I hear have them moving to Wyoming.

The Amarillo Globe-News has a message for gun manufacturers thinking of relocating to Texas: Come on down!

Texas executes its 500th murderer. Don’t mess with Texas. Or we will end you.

Speaking of ending you: Don’t try to commit armed robbery in a concealed carry state.

Nurse Bloomberg continues to underwrite anti-gun ads, shoot himself in the foot. (Hat tip: Alphecca.

In order to prove vegans aren’t a creepy cult, website seeks to out and harass lapsed vegans.

The Onion channels Jay Carney: “Well, Time To Go Out In Front Of A Bunch Of People And Lie To Them.”

The mystery of Lori Ruff, AKA Becky Sue Turner. No one know who she actually is…

Tags:amnesty, Benghazi, Border Controls, Colorado, Crime, Democrats, Euro, Foreign Policy, Greece, Guns, Hezbollah, Illegal Aliens, Indiana, IRS, Jihad, Lebanon, Libya, Magpul, Marco Rubio, Michael Bloomberg, NHS, Noam Chomsky, Obama Scandals, Republicans, Socialized Medicine, Syria, Texas, vegans, Voter Fraud

Posted in Austin, Border Control, Crime, Democrats, Elections, Guns, Jihad, Obama Scandals | No Comments »

Wednesday, April 17th, 2013

While attention was focused on the Boston bombing, Gosnell, and gay marriage, Greece just got another bailout. This is in exchange for further “austerity.”

What sort of “austerity” is Greece practicing? The sort that involves deficit spending at 10% of GDP, which is up from 9%. It was supposed to be cut to 7.5%.

So Greece wants more money because it can’t even keep to its previous promises on its fake austerity goals.

Let me explain it once again: Real austerity is cutting spending until it matches incoming receipts. Not reducing the rate of deficit spending. Not raising taxes so politicians can continue to spend.

No country in the EU (at least outside the Baltics) has practiced real austerity. That Forbes piece on the Baltic nations includes a lot of good advice that EU nations are largely ignoring:

Don’t run up big debts. It is a lot easier to manage when things go bad if you aren’t overextended to start. Observed Rosenberg: “Estonia’s experience shows that prudent policies during the boom may not avoid a bust, but they can put the country into a better position to deal with shocks.”

Don’t engage in an orgy of “stimulus” spending. That will run up big debts without generating long-term growth. When budgets eventually are cut, as they will have to be, the economic loss and political pain will be even greater.

Make tough decisions early. People typically are ready to act after the crisis hits. In the case of Latvia, argued Asmussen, by acting swiftly “most of the required painful budgetary decisions could be passed before the so-called ‘adjustment fatigue’ kicked in.”

Maintain fiscal responsibility. Otherwise any progress will be transitory. Growth is the natural result of reform. Delaying reform exacerbates the problem while prematurely terminating reform short-circuits the recovery.

Emphasize budget cuts. Expansive and irresponsible public outlays usually contribute to economic crisis. Moreover, the state as well as citizens should sacrifice after a crash. The answer is to cut expansive and irresponsible public outlays. In fact, economists Alberto Alesina and Silvia Ardagna found that “spending cuts are much more effective than tax increases in stabilizing the debt and avoiding economic downturns. In fact, we uncover several episodes in which spending cuts adopted to reduce deficits have been associated with economic expansions rather than recessions.”

Finally, don’t rest on one’s laurels. There always is more to do. Even nations which have implemented serious reform programs, like the Baltic States, could make further improvements.

As far as I can tell, none of the core EU states (and certainly none of the PIIGS) has tried this approach since the 2008 recession hit. They keep trying Neo-Keynesian pump-priming and deficit spending to keep both the Euro and their unsustainable welfare state afloat, and they keep experiencing endless recession. Their fake austerity comes in slightly reducing the amount of their deficit spending enough to pretend they’re in compliance to keep the bailouts coming. Ireland hasn’t practiced real austerity. Neither has Portugal, Spain, or Italy (though Italy has come closest).

The shell game of bailouts and fake austerity will continue as long as the Eurocrats can keep getting away with it.

Tags:Euro, Europe, European Debt Crisis, Greece, PIIGS, unions, waste, Welfare State

Posted in Budget, Economics, Foreign Policy, unions, Waste and Fraud, Welfare State | 1 Comment »

Thursday, March 14th, 2013

This week we’ll do it Thursday rather than Friday:

Obama is trying to work the same magic on America’s economy that a half century of Democratic rule has worked in Detroit. More details here.

And Detroit’s former mayor Kwame Kilpatrick is going to prison.

Since 2002, total federal spending has increased 89% while median household income has dropped 5%.

In Iran, 5 of top 10 porn search terms are for gay porn (no nudity, but NSFW-ish terms, and the usual warning that it’s (ick) Gawker).

Thanks to ObamaCare, your veterinarian bills are going up as well as your medical bills.

Thomas Friedman hates the Keystone pipeline because the oil is dirty, but loves China, where industry is a thousand time dirtier than here in the U.S. And where will that oil go if the pipeline isn’t built? China. Maybe Friedman just wants all the jobs to be in China. That, or actual checks from the Chinese government or their business subsidiaries, would explain an awful lot of Friedman’s writing over the last few years…

“Most developed nations are fundamentally broke.”

The degrees of broke-ness varies: from completely and utterly broke, like Greece or Italy; to wobbly, like the U.K., France, the U.S., or Japan; to getting poorer like Germany. But all of them are going to have to raise the percentage of gross domestic product they collect in tax — and many of them very significantly.

The U.S. deficit is more than 7% of GDP. The U.K.’s deficit is just as high. There is very little sign that spending cuts to close gaps of that magnitude are on the cards, nor is there any sign that growth will be sufficiently strong to make up the difference — certainly not in countries like the U.K. or Japan.

Huge sums of additional revenue will have to be raised.

Willie Sutton once famously remarked that he robbed banks because “that’s where the money is.”

In the same way, governments will look to raise more tax from companies because that’s where the money is.

Or they could, you know, actually cut spending…

I’ve not been following the Prenda Law case closely. Fortunately, Ken over at Popehat has. Exceptionally brief background: Scumbag copyright troll lawyers operate shakedown operation, filing dubious (at best) copyright infringement lawsuits. Then they compounded the problem by suing bloggers and lawyers in an attempt to silence them. As you might expect, that strategy isn’t working out very well for them… (Hat tip: Dwight)

Florida Democrats want mandatory anger management classes for people buying ammo.

From Popcap Games, the makers of Plants vs. Zombies, comes Trees vs. Rockets. Wait, did I say Popcap Games? I meant the Israeli Defense Forces.

White House journalists as Ring-Wraiths.

Third round of Climategate documents released?

Michael Totten says that Lebanon is ready to explode from the spillover effect of the Syrian Civil War.

News of the horrific 5-year old terrorist who brandished her fearsome Hello Kitty assault bubble gun (link fixed).

Tags:China, Democrats, Detroit, Energy Policy, Greece, Guns, Hezbollah, Iran, Israel, Italy, Keystone Pipeline, Kwame Kilpatrick, Lebanon, ObamaCare, Popehat, Prenda Law, Syria

Posted in Budget, Democrats, Economics, Foreign Policy, Global Warming, Guns, ObamaCare | No Comments »

Friday, January 4th, 2013

Judging from the Fiscal Cliff votes, the United States appears to be eager to follow in the footsteps of Greece and California, rushing to unsustainable spending, crushing debt loads and inevitable bankruptcy, rather than following the lead of Texas and the Red State model of debt-free limited government and free enterprise. So let’s see where the two states are, shall we?

Via Reason comes a link to the website Pension Tsunami, which contains much of interest for those charting California’s decline.

One method California cities are using to continue funding their heroin outrageous pension spending habit is issuing Pension Obligation Bonds, where they sell bonds to pay for pension obligations and then invest them. Indeed, some that got burned by the tactic in the 1990s (like Oakland) are trying again. “Bonds issued in 1997 were, on average, underwater in 2007, even before the stock market crash…’That’s like a compulsive gambler telling you that he has to bet it all on red to make up for his past losses.’”

“Bankruptcy is the best bet most cities have for getting out of their crushing health and retirement obligations to public workers….Government employee compensation, mostly for health and retirement, is at the heart of nearly all the current and looming municipal bankruptcies across the country.”

Federal judge to Calpers: No, you can’t rewrite bankruptcy laws to save outrageous union pensions. Not yours.

California: Pensions or Police? Pick one.

Stockton attempts to pull a Chrysler, attempting to screw its bondholders in a bid to leave outrageous union pensions untouched.

While California wonders how to fill it’s perpetual budget shortfall, Texas debates what to do with its surplus.

Over at TPPF, Chuck Devore wonders why Californians don’t stage a tax revolt. “In the meantime, Texas will be more than happy to receive into its welcoming arms people who want to work hard, invest, and create jobs.”

Want a glimpse of California’s future? Spain is running out of pension fund to raid.

Tags:Blue State, California, CalPERs, Chuck DeVore, Democrats, Fiscal Cliff, fraud, Greece, Spain, Texas, unions, waste, Welfare State

Posted in Budget, Democrats, Texas, unions, Waste and Fraud, Welfare State | No Comments »

Tuesday, January 1st, 2013

Just in case you hadn’t seen it before, here’s Dave Barry’s 2012 year-end roundup, to spread some light and cheer in a very dismal year.

In Europe, the economic crisis continues to worsen as the government of Greece, desperate for revenue, is forced to lease the Parthenon to Hooters. Meanwhile Moody’s Investors Service officially downgrades the credit rating of Spain to “putrid” after an audit reveals that the national treasury consists entirely of Groupons.

Abroad, a closely watched attempt by North Korea to test a long-range rocket capable of carrying a nuclear warhead ends in an embarrassing failure when, moments before the scheduled launch, the rocket is eaten by North Korean citizens.

In finance, Moody’s downgrades Spain’s credit rating from “putrid” to “rancid” when the Spanish government, attempting to write a check, is unable to produce a valid photo ID. Meanwhile the Greek parliament, meeting in an emergency session on the worsening economic crisis, votes to give heroin a try.

Voters in the French presidential election, rejecting the austerity program of incumbent Nicolas Sarkozy, choose, as their new leader, Charlie Sheen. In other European economic crisis news, Greece, seeing a way out of its financial woes, invests all of its remaining money in the initial public offering of Facebook stock, which immediately drops faster than Snooki’s underpants.

New York Mayor Michael Bloomberg, having dealt with all of the city’s other concerns – disaster preparation, for example – turns his attention to the lone remaining problem facing New Yorkers: soft drinks. For far too long, these uncontrolled beverages have roamed the city in vicious large-container packs, forcing innocent people to drink them and become obese. Mayor Bloomberg’s plan would prohibit the sale of soft drinks in containers larger than 16 ounces, thereby making it impossible to consume larger quantities, unless of course somebody bought two containers, but the mayor is confident that nobody except him would ever be smart enough to think of that.

Tensions continue to rise in the Middle East when Iran unveils a new surface-to-surface ballistic missile named “Conqueror,” which, according to an Iranian spokesman, will be used for “agriculture.” Elsewhere in the troubled region, an unmanned Predator drone hacks Waziristan’s Twitter account and posts pictures of itself naked.

In the European economic crisis, an increasingly desperate Greece offers to have sex with Germany.

In labor news, Chicago teachers go on strike over controversial proposed contract changes that would allow the school board to terminate teachers who have passed away.

I don’t even need to tell you to read the whole thing, do I?

Tags:Dave Barry, Greece, humor, Iran, Media Watch, Satire

Posted in Media Watch | No Comments »

Tuesday, July 17th, 2012

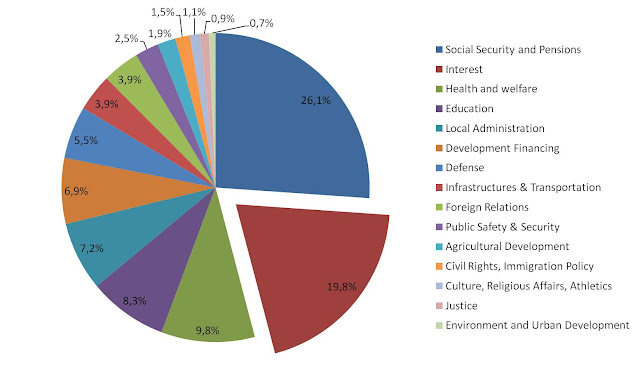

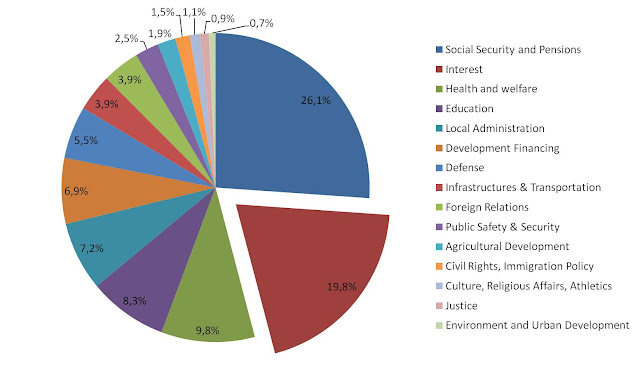

In order to divert attention away from the economic, moral, and political bankruptcy of Europe’s cradle-to-grave welfare state, some liberals, relying on figures from the Out of Our Ass Institute of Statistics, are tying to claim that Greece’s excessive spending comes from a “bloated defense budget.”

Try again. Greece only spends 5.5% of it’s budget on defense:

Either Europe (and the United States) must reform their runaway, bloated welfare states, or their welfare states will bankrupt their nations.

Tags:Euro, European Debt Crisis, Greece, Welfare State

Posted in Budget, Economics, Welfare State | 2 Comments »

Sunday, June 17th, 2012

Feeling less suicidal than usual, Greek voters have opted for the conservative (for Greece) New Democracy party in parliamentary elections, beating out the radical-left Syriza, which insisted Europe keep shoveling money into the black hole that is the Greek budget, but rejected even the fake austerity the Eurocrats demanded. New Democracy leader Antonis Samaras has his work cut out for him, convincing the Eurocrats that yes, this time, they really are implementing austerity. This time for sure!

Look for this to help forestall the inevitable “grexit” for, oh, maybe three months. Which is when I bet Greece will find out it can’t pay it’s bills again after the latest infusion of cash, the money Europe kicked in will have strangely disappeared without seeming to have been spent on any fundamental government services, and insiders will have managed to transfer another few months of funds into their out-of-country banks accounts in advance of the next crisis…

Tags:2012 Election, Antonis Samaras, Budget, Elections, Euro, Europe, European Debt Crisis, Foreign Policy, Greece, grexit, Welfare State

Posted in Budget, Elections, Foreign Policy, Welfare State | No Comments »

Friday, June 15th, 2012

So Greeks head off to the polls this weekend to (theoretically) choose whether to muddle along with a “right” (for Greece) government that will actually attempt to carry out something vaguely resembling austerity, or for Alexis Tsipras’ far-left Syriza party, who intends to re-enact Clevon Little’s scene from Blazing Saddles: “Drop the austerity demands, or I’ll drop out of the Euro and refuse to let Germany bail us out anymore!” “Do what he says, do what he says, that Greek’s crazy!” It’s anybody’s guess whether Greece will opt to keep the farce going for another few months, or finally set the whole house of cards tumbling down.

My guess is that there are still enough insiders who can benefits from dumping PIIGS bonds onto various sets of European taxpayers, so I expect that, one way or another, the Eurocrats will find a way to keep the charade up for another two or three months.

In light of that, here’s a roundup of Euro debt news:

Forget grexit. The new hotness is Spexit and Spanic.

Which is why the EU just gave Spain a €100 billion life preserver. That should be good for, what, three months?

Which is why Fitch and Moody’s downgraded Spanish banks and debt.

Which is why Spanish borrowing costs have soared.

And Spain’s deal? Ireland wants some of that. And given the way Irish taxpayers were made to eat Anglo Irish Bank’s debts, I can’t say that I blame them.

And did I mention that Italy’s debt market might collapse?

Which explains why Italy is making noises about actual budget cuts and selling off state owned assets. Naturally, Italian unions are threaten to strike.

“By any objective criteria the Euro has failed, and in fact there is a looming, impending disaster.”

Tsipras has all but flipped Merkel off.

And Merkel fliped him off back.

Europe prepares for an influx of Greek refugees. And by “prepares,” I mean “prepares to keep them out.”

France and Spain want to dig faster.

Obama is boned because Europe is boned.

How the Euro will end: “Greece will simply run out of cash. Then Spain’s real-estate bubble will ruin an economy that really matters.”

Still not completely depressed about Europe’s prospects for escaping the trap created by their bankrupt cradle-to-grave welfare states? Well then, here’s some Mark Steyn to cruelly stomp on those last flickering embers of hope.

Have a happy weekend!

Tags:Alexis Tsipras, Angela Merkel, Budget, Euro, Europe, European Debt Crisis, Germany, Greece, Ireland, Mark Steyn, PIIGS, Spain, Syriza, Welfare State

Posted in Budget, Economics, Foreign Policy, Welfare State | 2 Comments »

Friday, June 1st, 2012

How about a nice slice of EuroDoom to ease you into the weekend?

With all the post-primary news, the European Debt Crises news has been chugging along for a while now. let’s look at some, shall we?

Heh. “The Euro cannot be destroyed by any craft that we here possess. It was made in the fires of Frankfurt. Only there can it be unmade. It must be taken deep into the heart of the European Central Bank, and cast back into the fiery chasm from whence it came!”

If the Leftists win the next round of voting in Greece, they promise to cancel the EU-sponsored bail-out and re-nationalize banks and companies. Way to calm the markets, dude! Not to mention reenacting Clevon Little’s famous scene from Blazing Saddles. “Experience is a dear teacher, but fools will learn from no other.”

“It is no longer a question of if, but how, Greece will leave the euro.”

The money flight from Greek banks continues.

And there’s this: “I can see only one mechanism that could force a collapse of the eurozone: a generalised bank run in several countries.”

In the showdown between Greece and the IMF, both sides deserve to lose.

NEIN! “Almost 80% of Germans reject eurobonds and 60% are against Greece remaining in the euro.”

Germany and Greece play chicken over the euro. That’s like a Mercedes playing chicken with a [ERROR: NO GREEK AUTOMAKER FOUND. ANALOGY ABORTED.]

Ireland votes yes on the Fiscal treaty, and then turns around with an implied “Now fork it over, Otto.”

Why Germany is great and Spain is totally screwed.

It’s a winner-take-all world. Countries that do well have to do a few things extremely well. Germany makes the world’s best machine tools, some of the best heavy engineering equipment, not to mention autos. German manufacturing dominates innumerable key niches. The Spanish don’t do anything well. They haven’t done anything well since the Spanish Empire outsourced its manufacturing to Flanders in the 16th century.

And Spain is really screwed.

Which is why the Germans seem inclined to let them have more rope.

Though at least one source says reports of Spanish bank runs are exaggerated.

But even Germans are getting nervous. Also this:

As a journalist told me yesterday, he worries whether the money in his pocket will be worth anything a year from now. Others worry about Germany’s increasingly negative image among recession-hit southern and eastern Europeans. Americans will understand this feeling well: you pay and pay to help others, only to have them turn on you in hatred and wrath, accusing you of horrible hidden motives and denouncing your selfishness.

Eurobills instead of Eurobonds?

Tags:Euro, Europe, European Debt Crisis, Germany, Greece, Ireland, Spain, Welfare State

Posted in Budget, Economics, Elections, Foreign Policy, Waste and Fraud, Welfare State | 1 Comment »

Thursday, May 24th, 2012

Are the Greeks already printing Drachmas? So says a completely unverified tweet from a random Twitter user. Really, what better source could you possibly ask for?

The Internet is alive with buzz on Greece exiting the Euro (see #grexit for a sip from the firehose). Sadly, there seems to be no buzz at all on reigning in the cradle-to-grave European welfare state that caused the crises in the first place.

More Grext/European debt crises news:

The Fraud of Austerity.

The European debt crises as the world’s longest root canal with the world’s dullest dental drill.

How lovely: diseases unknown to Europe are making a comeback thanks to the Greek government’s colossal mismanagement.

Problem: Greece’s government will seize their citizens’ Euros to forcibly convert them into Drachmas. Solution: Withdraw your cash in Euros. Problem: Burgler’s have figured this out too.

Spain’s Prime Minster: Screw the long term Euro plans, I need the European Central Bank’s sweet low rates right now.

Maybe because his government just pumped €9 billion into failing banks.

Who’s most exposed to the grexit? Italian and Spanish insurers.

There’s no conflict between real austerity and pro-growth polices. Too bad no one in Europe is willing to try them.

Wait, The Guardian actually printed an editorial by John Bolton? (“And the moon became as blood…”) It’s a good one, too:

“Growth” to social democrats means growth in government’s size and reach, not growth in the real economy. This approach directly contributed to our current predicament; and more of the same will only exacerbate it.

Tags:Euro, Europe, European Central Bank, European Debt Crisis, Greece, grexit, Italy, John Bolton, Spain, Welfare State

Posted in Budget, Economics, Foreign Policy, Waste and Fraud, Welfare State | No Comments »