Posts Tagged ‘Los Angeles’

Wednesday, September 14th, 2016

Time for another Texas vs. California update:

Vance Ginn makes the case that Texas is still kicking California’s ass:

After descending into a deep valley during the recession, California’s economy has recently grown at a faster rate than in Texas, where the drop in oil prices and higher value of the dollar have negatively affected the mining and manufacturing sectors. However, during the last decade, the productive, real private sector growth has increased by 13.6 percent in California compared with a robust 29.1 percent in Texas.

This growth translates into output per person in Texas increasing almost four times more than in California in that period, meaning economic output has far outpaced population growth.

Although contemporary economic growth in California has led to a higher annual job creation rate than in Texas since April 2015, this only tells part of the story.

Since December 2007 when the last national recession started, total civilian employment increased in California by 1.2 million while it increased by 1.7 million in Texas, with a labor force two-thirds the size of California’s. This increase in employment in Texas constitutes about one-third of all jobs created nationwide — truly remarkable given recent headwinds!

This phenomenal job creation contributed to Texas’ unemployment rate (4.6 percent) being at or below California’s rate (5.5 percent) for 121 straight months, or since July 2006. But the official unemployment rate only accounts for those actually looking for work, a better gauge of labor force health would be the share of the population employed, which has been higher in Texas than in California since at least 2000.

More economic output and job creation over time in Texas has contributed to less poverty. The Bureau of Labor Statistics’ supplemental poverty measure, which accounts for the local cost of living, shows that Texas’ rate matches the national average while California has the nation’s highest poverty rate

Income inequality has also been higher in California than in Texas for years. For example, the average of total income held by the top 10 percent of income earners from 2000 to 2012 was 49.9 percent in California compared with 48.8 percent in Texas.

The results are pretty clear that California’s progressive policies of having the highest marginal personal income tax rate, cumbersome regulations, huge unfunded pension obligations, an out of control lawsuit environment, and other policies reduce economic opportunity.

(Hat tip: Pension Tsunami.)

High earners are leaving blue states like California for red states like Texas:

For generations, the Golden State developed a reputation as the ultimate destination of choice for millions of Americans. No longer. Since 2000 the state has lost 1.75 million net domestic migrants, according to Census Bureau estimates. And even amid an economic recovery, the pattern of outmigration continued in 2014, with a loss of 57,900 people and an attraction ratio of 88.5, placing the Golden State 13th from the bottom, well behind longtime people exporters Ohio, Indiana, Kentucky and Louisiana. California was a net loser of domestic migrants in all age categories.

Snip.

Much of the discussion about millennial migration tends to focus on high-cost, dense urban regions such as those that dominate New York, Massachusetts and, of course, California. Yet the IRS data tells us a very different story about migrants aged 26 to 34. Here it’s Texas in the lead, and by a wide margin, followed by Oregon, Colorado, Washington, Nevada, North Dakota, South Carolina, Maine, Florida and New Hampshire. Once again New York and Illinois stand out as the biggest losers in this age category.

Perhaps more important for the immediate future may be the migration of people at the peak of their careers, those aged 35 to 54. These are also the age cohorts most likely to be raising children. The top four are the same in both cohorts. Among the 35 to 44 age group, it’s Texas, followed by Florida, South Carolina and North Dakota. Among the 45 to 54 cohort, Texas, followed by South Carolina, Florida and North Dakota.

California just raised your food costs.

And agricultural producers are not happy:

The Governor signed this ag overtime bill in the same year that minimum wage legislation was also passed that will take California to the highest minimum wage as well as legislation forcing California to adopt additional greenhouse gas regulations for businesses in California.

California is the only state in the country subject to such regulations. Today’s signing occurred despite numerous requests by the agricultural industry to meet with the Governor to discuss our concerns. The message is clear. California simply doesn’t care.

Ca;ifornia companies have a hard time attracting workers:

More than two-thirds (70 percent) of organizations in California indicated that they have had difficulty recruiting for full-time regular positions in the last 12 months, similar to 68 percent nationally.

California organizations were more likely than organizations nationally to report competition from other employers (56 percent), qualified candidates rejecting compensation packages (28 percent), qualified candidates not being able to move to their local area (21 percent), or a relocation or a relocation package not being competitive or not being offered (12 percent) as top reasons for hiring difficulty.

Why California can’t build more housing. “Labor unions—which ostensibly stand for working class interests—will not stand for new construction unless it is accompanied by carve-outs and cronyist regulations that artificially boost their compensation.” (Hat tip: Instapundit.)

Stop me if you’ve heard this one before: “California’s unfunded pension debts may be larger than acknowledged.” (Hat tip: Pension Tsunami.)

“The biggest problem faced by the State of California is not ‘climate change’ or ‘poverty it is the overreaching power of California government itself, namely the California Legislature and Administration, and the threats that this Democrat establishment poses to California’s future, particularly with regard to the economy and individual liberty. California Democrats are celebrating the passage of new climate change legislation that provides California government with broad, sweeping new powers to drastically curb greenhouse gas reductions without regard to economic impact or the basic rights of businesses and individuals.” (Hat tip: Pension Tsunami.)

Palo Alto decides that they hate, hate, hate that golden goose.

Maybe that’s why some observers are telling people “If You Own A Home In Palo Alto, CA; Sell It Now.” As the median price of homes has actually started dropping, though from admittedly already insane heights…

“Case Study: How Politicians Motivate Companies to Leave California.”

Orange County clerk took bribes to make charges disappear.

Corrupt Oakland police sentenced. There are all sorts of real winners in this story…

“LAX Police Assistant Chief Resigns Amid Corruption Allegations.”

University of California hires India-based IT outsourcer, lays off tech workers. “The layoffs will happen at the end of February, but before the final day arrives the IT employees expect to train foreign replacements from India-based IT services firm HCL. The firm is working under a university contract valued at $50 million over five years.” This might be a good time to throw in a “How’s that $15 minimum wage working out for you, San Francisco,” but there’s another factor at work: “Joe Bengfort, the CIO for the UCSF campus, said the campus is facing ‘difficult circumstances’ because of declining reimbursement and the impact of the Affordable Healthcare Act, which has increased the volume of patients but limits reimbursement to around 55 cents on the dollar, he said.” So San Franciscans IT workers are losing their jobs thanks to ObamaCare.

“Texas has proven it’s possible to have both much lower crime and a lower rate of imprisonment. Indeed, Texas’ FBI index crime rate, which accounts for both violent crime and property crime, has fallen more sharply than it has nationally, posting a 29 percent drop from 2005 to 2014, the latest full year for which official data is available.”

“It turns out that the average property tax bill required to support BART’s proposed $3.5 billion bond measure on the November ballot could be as much as four times what the transit agency claimed…That’s because legal language in Measure RR allows BART to issue bonds at up to the state limit of 12 percent interest.” 12%? With 30 year U.S. Treasuries running under 2%? The fact they think they may have to go that high to attract investors suggests how worried bond traders are about the future of California’s economy…

Some are less than enthused about BART’s bond proposal:

BART officials want voters to trust them with another $3.5 billion of taxpayer money. But they’ve done nothing to earn that trust.

Instead, they have recklessly spent what they have, grossly understated how much their ballot proposal would raise property tax bills and devised plans to use money from the measure, intended for capital projects, to indirectly cover inflated labor costs.

Voters in Alameda County, Contra Costa and San Francisco should say no — hell no. They should reject Measure RR on the Nov. 8 ballot.

Despite the problems facing the transit agency, it makes no sense to approve five decades of extra taxes when Measure RR lacks a logical budget, a timeline for service improvements and provisions ensuring taxpayers and riders get what they’re promised.

The measure would authorize the district to borrow $3.5 billion through bond sales as part of a larger plan to upgrade BART’s infrastructure. The ballot wording conveniently omits that the district would tax property owners for 48 years to pay off the debt.

(Hat tip: Pension Tsunami.)

Speaking of California bonds: Proposition 53 explained.

California’s legislature passes extension of sexual assault statue of limitations mainly over Bill Cosby. Combine this with the trend of colleges redefining rape to “any sex a woman later regrets,” and suddenly the state has the ability to prosecute anyone who ever had sex in California…

Leprosy Scare in California Elementary School. “There are approximately 6,500 cases of leprosy in the United States, and 90 percent of the cases are immigrants from countries where leprosy is endemic.With the increase in illegal immigrants and refugees in recent years, diseases thought to be eradicated in this country — like tuberculosis, polio, measles and leprosy — have unfortunately reemerged in the United States.” (Hat tip: Ed Driscoll at Instapundit.)

Image Comics to move from Berkeley to Portland.

“Cow Fart Regulations Approved By California’s Legislature.” No, not an Onion piece.

Follow-up: Pacific Sunwear exits bankruptcy.

Tags:agriculture, bankruptcy, BART, Berkeley, Bill Cosby, Border Controls, California, Crime, Los Angeles, minimum wage, Oakland, ObamaCare, Orange County, Pacific Sunwear, pension crisis, Portland, Proposition 53 (California), rape, Texas, unions, Vance Ginn

Posted in Crime, Democrats, ObamaCare, Texas, unions | No Comments »

Thursday, June 2nd, 2016

Time for another Texas vs. California update:

Once again, Texas is ranked as the best state for business by CEO Magazine, while California is ranked the worst. (Hat tip: Rider Rants via Pension Tsunami.)

This OC Register piece offers an good restatement of the general problem:

California has earned quite a reputation for being openly hostile to business, as confirmed by numerous studies and surveys. Its plethora of taxes and regulations are driving away legions of entrepreneurs and workers, but they are doing wonders for one segment of the economy: the moving industry. It is almost as though that industry is secretly lobbying the state Legislature for its anti-business policies.

Joe Vranich, as president of Spectrum Location Solutions, an Irvine business relocation consulting firm, knows all about what drives businesses’ decisions to give up and leave for greener pastures. According to his research, in just the past seven years, approximately 9,000 businesses have decided to leave California or expand their operations out of state. Companies leaving California typically save between 20 percent and 35 percent of operating costs, he concluded.

Texas has been the biggest beneficiary of California’s business exodus.

Snip.

California’s litigious climate has become a common complaint of business owners. No wonder the American Tort Reform Foundation once again named California the No. 1 “Judicial Hellhole” in the nation last year, based on the state’s excessive laws and regulations and a flood of disability access, asbestos and food advertising and labeling lawsuits, frequently more opportunistic attempts at extortion than legitimate attempts to seek justice for victims who have been truly harmed.

California has proven to be a particularly harsh climate for manufacturing businesses. “Even if California were to eliminate the state income taxes tomorrow, that still would not be enough,” CellPoint Corp. CEO Ehsan Gharatappeh told the Dallas Business Journal of the Costa Mesa company’s move to Forth Worth.

General Magnaplate Corp., which has made reinforced parts for the aerospace, transportation, medical, oil and other industries for 36 years, decided to shut down its California facility in Ventura altogether. “This is a very sad day for our employees and for my family, who have a long history of job creation in this area, but the simple fact is that the state of California does not provide a business-friendly environment,” CEO Candida Aversenti said in a press release. “Increases in workers’ compensation costs and government regulations, combined with predatory citizens groups and law firms that make their living entirely by preying on small businesses, have left us with no other choice but to shut down our California facility. This is in stark contrast to our New Jersey and Texas facilities, which are flourishing in small business-friendly environments created by the respective local governments and environmental agencies.”

Tech layoffs double in the Bay area:

Yahoo’s 279 workers let go this year contributed to the 3,135 tech jobs lost in the four-county region of Santa Clara, San Mateo, Alameda and San Francisco counties from January through April, as did the 50 workers axed at Toshiba America in Livermore and the 71 at Autodesk in San Francisco. In the first four months of last year, just 1,515 Bay Area tech workers were laid off, according to mandatory filings under California’s WARN Act. For that period in 2014, the region’s tech layoffs numbered 1,330.

How did the California city of Irwindale rack up the largest per household market pension debt in the state, at $134,907 per household?

Low and negative interest rates means that CalPERS must make risky investments to even come close to hitting their yield targets:

The nation’s largest public pension fund, the California Public Employees’ Retirement System, has one-fifth of its assets in bonds and is down 1.3% since July 1, according to public documents. The system, known by its abbreviation Calpers, also has 53.1% of its assets in stocks, 9% in real estate and 9.4% in private equity. In 2015, Calpers posted a return of 2.4%, below its target rate of 7.5%.

Nor is CalSTARS doing much better:

The nation’s second-largest public pension plan, the California State Teachers’ Retirement System, has shifted a significant amount of money away from some stocks and bonds to protect against a downturn. It moved assets into U.S. Treasurys and so-called liquid-alternative funds, which mimic hedge-fund strategies. Calstrs, as the pension is called, reported gains of 1.5% during a choppy 2015, with returns on its fixed-income investments up just 0.6%.

(Note: WSJ link, so you may need to do the Google thing.)

News: Former CalPERS chief executive Fred Buenrostro convicted of bribery. California: Buenrostro will continue to receive his CalPERS pension while in prison. (Hat tip: Pension Tsunami.)

Overview of the Texas budget.

UnitedHealth exits California’s Obamacare exchanges.

Despite that, California wants to offer ObamaCare subsidies to illegal aliens.

California also wants to spend more money to send illegal aliens to college.

And those illegal aliens with California driver’s licenses still aren’t purchasing liability insurance.

Hate California traffic? Tough:

The newest outrage comes from the Governor’s Office of Planning and Research in the form of a proposed “road diet.” This would essentially halt attempts to expand or improve our roads, even when improvements have been approved by voters. This strategy can only make life worse for most Californians, since nearly 85 percent of us use a car to get to work. This in a state that already has among the worst-maintained roads in the country, with two-thirds of them in poor or mediocre condition.

Snip.

In essence, the notion animating the “road diet” is to make congestion so terrible that people will be forced out of their cars and onto transit. It’s not planning for how to make the ways people live today more sustainable. It has, in fact, more in common with Soviet-style social engineering, which was based similarly on a particular notion of “science” and progressive values.

(Hat tip: Instapundit.)

Toyota’s Plano headquarters takes shape.

The UAW is making a big push to unionize Tesla’s Fremont plant.

Speaking of Tesla, they’re approaching the grand opening of their giant battery factory…in Nevada.

McDonald’s CEO says a $15 minimum wage will make his restaurants shift to using robots. But what would McDonald’s know about minimum wage workers?

In the same vein, it’s no wonder that Whole Foods opened it’s first semi-automated Whole Foods 365 store in Los Angeles. “Promoted as a ‘chain for millennials,’ the new ‘365’ stores use about one-third less square footage than the company’s traditional 41,000-square-foot Whole Foods stores, but they also slash almost two-thirds of workers with robots and computerized kiosks.” (Hat tip: Director Blue.)

Schedule for California high speed rail boondoggle pushed back four more years. Latest obstacle: wealthy equestrians. “Hey, this study says horses won’t mind a super-fast, super loud train zipping along right next to them.” “You mean the study from the institute that two bullet train authority members sit on? Get stuffed!”

“The State Assembly Subcommittee on Education voted Tuesday to delay funding to the UC system because of concerns with the UC Retirement Plan, proposed by UC President Janet Napolitano in March, which would cause the university to incur significant costs. The delay was announced after an actuarial report was released earlier that day by Pension Trustees Advisors, or PTA, which showed that the retirement plan would cost the university $500 million in savings, or $34 million a year, over the next 15 years.” (Hat tip: Pension Tsunami.)

Maywood, California (which had previously outsourced services to the corrupt city of Bell) is on the brink of bankruptcy. (Hat tip: Dwight.)

“Two L.A. sheriff’s deputies convicted of beating mentally ill inmate.”

San Francisco liberals versus the city’s police union

“Another aviation company has decided to move its corporate headquarters to Fort Worth to take advantage of the Lone Star state’s business friendly environment and the city’s longtime history in the aerospace industry. The move is historic for Burbank, California-based C&S Propeller — an FAA and EASA certified repair station for propeller and airplane maintenance — which has been in California for nearly five decades.”

This one’s a wash: XCOR lays off employees in both California and Texas.

Tags:Autodesk, Border Controls, California, CalPERs, CalSTARS, CellPoint, Crime, Democrats, Fred Buenrostro, Ft. Worth, General Magnaplate, Irwindale, Legislative Budget Board, Los Angeles, Maywood, McDonald's, minimum wage, Nevada, ObamaCare, Plano, San Francisco, Tesla Motors, Texas, Toshiba, Toyota, UnitedHealth, Welfare State, Whole Foods, XCOR, Yahoo

Posted in Border Control, Budget, Crime, Democrats, ObamaCare, unions, Welfare State | 1 Comment »

Monday, April 18th, 2016

Time for another Texas vs. California roundup, with the top news being California’s hastening their economic demise with a suicidal minimum wage hike:

Jerry Brown admits the minimum wage hike doesn’t make economic sense, then signs it anyway. (Hat tip: Ed Driscoll at Instapundit.)

Who is really behind the minimum wage hike? The SEIU:

California’s drive to hike the minimum wage has little to do with average workers and everything to do with the Golden State’s all-powerful government employee unions.

Nationally, the Service Employees International Union (SEIU) is known for representing lower skilled workers. But, of the SEIU’s 2.1 million dues-paying members, half work for the government. In California, that translates to clout with much of the $50 million SEIU spent in the U.S. on political activities and lobbying spent in California. In fact, out of the 12 “yes” votes for the minimum wage bill in the Assembly Committee on Appropriations on March 30, the SEIU had contributed almost $100,000 out of the three-quarters of a million contributed by public employee unions—yielding a far higher return on investment than anything Wall Street could produce.

Unions represent about 59 percent of all government workers in California. Many union contracts are tied to the minimum wage — boost the minimum wage and government union workers reap a huge windfall, courtesy of the overworked California taxpayer.

“The impacts of the increase in minimum wage on workers at the very bottom of the pay scales might be just the tip of the iceberg in terms of the ramifications of the minimum wage increase.” (Hat tip: Pension Tsunami.)

Indeed, that hike will push government employee wages up all up the ladder.

“California minimum wage hike hits L.A. apparel industry: ‘The exodus has begun.'” (Hat tip: Director Blue.)

“Texas’ job creation has helped keep the unemployment rate low at 4.3 percent, which has now been at or below the U.S. average rate for a remarkable 111 straight months.”

“Number of Californians Moving to Texas Hits Highest Level in Nearly a Decade”:

“California’s taxes and regulations are crushing businesses, and there are more opportunities in Texas for people to start new companies, get good jobs, and create better lives for their families,” said Nathan Nascimento, the director of state initiatives at Freedom Partners. “When tax and regulatory climates are bad, people will move to better economic environments—this phenomenon isn’t a mystery, it’s how marketplaces work. Not only should other state governments take note of this, but so should the federal government.”

According to Tom Gray of the Manhattan Institute, people may be leaving California for the employment opportunities, tax breaks, or less crowded living arrangements that other states offer.

“States with low unemployment rates, such as Texas, are drawing people from California, whose rate is above the national average,” Gray wrote. “Taxation also appears to be a factor, especially as it contributes to the business climate and, in turn, jobs.”

“Most of the destination states favored by Californians have lower taxes,” Gray wrote. “States that have gained the most at California’s expense are rated as having better business climates. The data suggest that may cost drivers—taxes, regulations, the high price of housing and commercial real estate, costly electricity, union power, and high labor costs—are prompting businesses to locate outside California, thus helping to drive the exodus.”

(Hat tip: Pension Tsunami.)

More on the same theme. (Hat tip: Pension Tsunami.)

It’s not just pensions: “The state paid $458 million in 2001 (0.6 percent of the general fund) for state worker retiree health care and is expected to pay $2 billion (1.7 percent of the general fund) next fiscal year — up 80 percent in just the last decade.” (Hat tip: Pension Tsunami.)

Texas border control succeeds where the Obama Administration fails. (Hat tip: Ace of Spades HQ.)

California and New York still lead Texas in billionaires. But for how long?

“The housing bubble may have collapsed, but the public-employee pension fund managers are still with us. If anything they’re bigger than ever, still insatiably seeking high returns just over the horizon line of another economic bubble.” (Hat tip: Pension Tsunami.)

How to fix San Francisco’s dysfunctional housing market. “Failed public policy and political leadership has resulted in a massive imbalance between how much the city’s population has grown this century versus how much housing has been built. The last thirteen years worth of new housing units built is approximately equal to the population growth of the last two years.” Also: “The city is forcing people out. Only the rich can live here because of the policies created by so-called progressives and so-called housing advocates.” (Hat tip: Ed Driscoll at Instapundit.)

UC Berkley to cut 500 jobs over two years.

What does BART do faced with a $400 million projected deficit over the next decade? Dig deeper. (Hat tip: Pension Tsunami.)

Stanton, California, is the latest California municipality facing bankruptcy. “One of the main reasons the city can’t pay its bills without the sales tax is that it gives outlandish salaries and benefits to its government workers.” (Hat tip: Pension Tsunami.)

Yesterday was Tax Freedom Day in Texas.

Politically correct investing has already cost CalPERS $3 billion. (Hat tip: Pension Tsunami.)

“A federal jury on Wednesday convicted former Los Angeles County Undersheriff Paul Tanaka of deliberately impeding an FBI investigation, capping a jail abuse and obstruction scandal that reached to the top echelons of the Sheriff’s Department.” (Hat tip: Dwight.)

Top California Democratic assemblyman Roger Hernandez accused of domestic violence.

Calls for UC Davis Chancellor Linda P.B. Katehi to resign, she of the supergenius “pay $175,000 to scrub the Internet of negative postings about the pepper-spraying of students in 2011” plan.

California beachwear retailer Pacific Sunwear files for Chapter 11 bankruptcy.

California retailer Sport Chalet is also shutting down.

75% of current Toyota employees are willing to move to Texas to work at Toyota’s new U.S. headquarters.

California isn’t the only place delusional politicians are pushing a “railroad to nowhere.” The Lone Star Rail District wants to keep getting and spending money despite the fact that Union Pacific said they couldn’t use their freight lines for a commuter train between Austin and San Antonio. The tiny little problem being that the Union Pacific line was the only one under consideration…

Tags:Austin, bankruptcy, BART, Berkeley, Border Controls, Budget, California, CalPERs, Chuck DeVore, Crime, Democrats, FBI, Jerry Brown, Linda P.B. Katehi, Los Angeles, Pacific Sunwear, Paul Tanaka, pension crisis, Roger Hernandez, San Antonio, San Francisco, SEIU, Sport Chalet, Stanton, Taxes, Texas, Toyota, UC Davis, unemployment, unions, Vance Ginn

Posted in Austin, Border Control, Budget, Crime, Democrats, Texas, unions | No Comments »

Monday, December 7th, 2015

Finally, some news from California that doesn’t involve radical islamic jihadis killing innocent people…

California lost 9,000 business HQs and expansions, mostly to Texas, 7-year study says. “It’s typical for companies leaving California to experience operating cost savings of 20 up to 35 percent.” (Hat tip: Pension Tsunami.)

Remember those “temporary taxes” that made California’s state income taxes the highest in the country? Well, to the all-devouring maw of a broke welfare state, no tax is temporary.

Los Angeles County: center of American poverty:

The Census Bureau’s 2012 decision to begin releasing an alternative measure of poverty that included cost of living has appeared to have far-reaching effects in California as politicians, community leaders and residents react to the new measure’s depiction of the Golden State as the most impoverished place in America.

The fact that about 23 percent of state residents are barely getting by has helped fuel the push for a much higher minimum wage and prompted renewed interest in affordable housing programs. It’s also put the focus on regional economic disparities, especially the fact that Silicon Valley and San Francisco are the primary engine of state prosperity.

While the tech boom and the vast increase in housing prices it has triggered in the Bay Area are national news, prompting think pieces and thoughtful analyses, the poverty picture in the state’s largest population center isn’t covered nearly as fully. Although the fact is plain in Census Bureau data, it’s not commonly understood that Los Angeles County is the capital of U.S. poverty. A 2013 study by the Public Policy Institute of California and the Stanford Center on Poverty and Inequality based on 2011 data found 27 percent of the county’s 10 million residents were impoverished, the highest figure in the state and the highest of any large metro area in the U.S.

Why California’s cities are in trouble: “The problems here, as the bankruptcies of San Bernardino and other cities have shown, are mismanagement and high costs incurred as a result of the state’s public-employee unions.” (Hat tip: Pension Tsunami.)

How CalPERS created a ticking time bomb. (Hat tip: Pension Tsunami.)

CalPERS also paid $3.4 billion in private equity firm fees since 1990, despite returns that were not that great. (Hat tip: Pension Tsunami.)

And CalPERS also has a huge problem with self-dealing and conflicts of interest. (Hat tip: Pension Tsunami.)

Texas’ largest employer is Wal-Mart. California’s largest employer is the University of California system.

But I doubt Wal-Mart has 35,065 employees who make more than $100,000 a year…

What good is California’s open meetings law if officials still feel free to ignore it? “Six decades after Brown Act passage, elected leaders still hold illegal meetings.” (Note: The Brown Act is named after Assemblyman Ralph M. Brown, D-Modesto, not either Jerry Brown.) (Hat tip: Pension Tsunami.)

Though Texas is doing much better at fiscal restraint than California, TPPF notes that Texas’ could still use additional spending restraint:

“Though Texas legislators did an excellent job by holding the total budget below population growth plus inflation during the last session, the state’s weak spending limit remains a primary cause of excessive budget growth during the last decade,” said Heflin. “Legislators can strengthen the limit by capping the total budget, basing the growth on the lowest of three metrics, and requiring a supermajority vote to exceed it. These reforms would have helped keep more money in Texans pockets where it belongs.”

“All segments of Texas housing market show strong gains in 2015.”

Mojave solar project operator files for bankruptcy.

“Fresh off of a major expansion, iconic San Francisco craft brewery Magnolia Brewing Co. filed voluntarily for Chapter 11 bankruptcy.” So a brewery that opened in 1997 is “iconic”?

“Fuhu Holdings Inc, a maker of kid-friendly computer tablets, has filed for Chapter 11 bankruptcy protection, according to a court filing on Monday.” Eh, included for completeness. That sounds like a bad business model for a startup no matter what state it was in…

Fresno Democratic assemblyman resigns to make more money in the private sector. Evidently a year to wait until his term expires was just too long to avoid climbing aboard the revolving door gravy train…

Tags:bankruptcy, California, CalPERs, Democrats, Fresno, Los Angeles, pension crisis, San Francisco, Texas, unions, waste, Welfare State

Posted in Democrats, Texas, unions, Waste and Fraud, Welfare State | No Comments »

Thursday, October 1st, 2015

Ah, that October chill…is not evident yet here in Austin. It’s supposed to hit 94° today.

Time for another Texas vs. California roundup:

The joys of working in Los Angeles: a $30,000 tax bill on $500 worth of freelance income.

California nears passage of another trial lawyer full employment act.

Texas had five of the ten fastest growing metropolitan areas in 2014. Austin isn’t on this list, but Midland and San Angelo are numbers one and two. (San Jose, California’s lone entry, checks in at eight.)

72% of Californians polled thinks the state has a pension crisis. Too bad this thinking doesn’t seem to influence their voting patterns yet… (Hat tip: Pension Tsunami.)

And yet a new bill would exempt some new hires from paying their fair share of pension costs. (Hat tip: Pension Tsunami.)

New pension accounting rules are about to show that a lot more California municipalities are insolvent.

“Instead of building freeways, expanding ports, restoring bridges and aqueducts, and constructing dams, desalination plants, and power stations, California’s taxpayers are pouring tens of billions each year into public sector pension funds.” (Hat tip: Pension Tsunami.)

Stockton’s bankruptcy didn’t solve it’s pension crisis.

Texas had a net gain of 103,465 people in 2014, the largest number of which came from California.

San Francisco wants to keep housing affordable…by restricting supply. Looks like somebody failed Economics 101…

Pension reform initiative to be refiled?

Unions are trying to undo San Diego’s voter-approved pension reforms. Because of course they are.

“Texas is like Australia with the handbrake off. There is no individual income tax and no corporate income tax, which explains the state’s rapid economic and population growth. A recent downturn has sparked some concern, however. Apparently Texas will only create another 150,000 jobs during 2015 – about the same number as Australia, from a population only a few million larger. In a good year, that number of jobs is easily generated by a single Texan city.” Also: IowaHawk’s illegal human organ trafficking!

Texas ranks 13th in budget transparency. California? Dead last.

Even some California Democrats balked at increasing the state’s already high gas prices.

As part of the bankruptcy of northwest supermarket chain Haggen (which bought a bunch of Albertson’s stores just six months ago), they’ll be closing all their California stores. And if you guessed that Haggen is unionized, you would be correct.

Jerry Brown revives the state’s redevelopment agency…and its potential for eminent domain abuse.

Reminder: Texas is enormous.

A scourge spreads out upon California. Crack gangs? Illegal aliens? Try “short term rentals.”

Historical note: 105 years ago today, three union guys bombed the Los Angeles Times, killing 21 people.

Tags:Albertson's, Australia, California, Crime, Democrats, Haggen, Jerry Brown, Los Angeles, Midland, pension crisis, San Angelo, San Jose, Stockton, Texas, unions, Welfare State

Posted in Crime, Democrats, Regulation, Uncategorized, unions, Waste and Fraud, Welfare State | No Comments »

Tuesday, September 8th, 2015

Time for another Texas vs. California roundup:

Why Texas is awesome:

First, there is no state income tax in Texas. Some people know this and some don’t—few really grasp what it means practically. It means that if you make decent money and decide to move here and rent something affordable, it’s essentially free to live in Texas. If you make $150,000 a year, your state income taxes in California are roughly $12,000 per year (in NYC it’s closer to $15,000). Or, you can put a thousand bucks a month toward your rent here. If you decide to buy, property taxes are high—but what you get for the money more than makes up for it. My editor at the Observer recently tried to cajole me into coming back to New York. Our house now—which has its own lake and is 29 minutes from the airport which never has lines—costs less than the rent we were paying for our lofted studio apartment in Midtown. Are you kidding?

Also note the mention of walk-in gun safes…

(Hat tip: Borepatch.)

600,000 Californians have moved to Texas since 2009.

Another take on that data: “5 Million People Left California Over the Past Decade. Many Went to Texas.”

Austin and Houston are the top two relocation destinations in the country.

$15 billion for a fish tunnel?

“The average full-career California teacher receives a pension benefit equal to 105% of their final earnings. CalSTRS CEO says the plan isn’t generous enough.”

In 2012, Los Angeles passed some modest pension reforms for newly hired employees. Surprise! A new union contract undoes those reforms. (Hat tip: Pension Tsunami.)

California, like Texas, has a homestead exemption built into their bankruptcy laws. Unlike Texas, California’s exemption doesn’t actually protect debtors.

The FBI raided Palm Springs’ city hall as part of a corruption probe.

Mining company suspends operations at California mine because rare earths aren’t.

Chief of tiny California fire district to have his $241,000 pension cut. (Hat tip: Pension Tsunami.)

Enviornmental idiocy and California’s drought.

Texas’ 2016 Fiscal Year started September 1st. “Several taxes that were eliminated on September 1 include the Inheritance Tax, Oil Regulation Tax, Sulphur Regulation Tax, Fireworks Tax, Controlled Substance Tax Certificates, and the Airline/Passenger Train Beverage Tax.”

Meanwhile, California’s legislature is trying to raise gas and tobacco taxes.

Elderly poverty in California.

Evidently California’s Democratic politicians stay up late at night devising ways they can make the state go broke even faster. The answer: Host the Olympics again.

Korean-owned businesses in LA consider relocating to El Paso. “Kim makes the case that El Paso, once home to plants for denim companies including Levi’s and Wrangler, has abundant skilled laborers, fewer regulations, much cheaper rent and direct flights from Los Angeles.”

A cartoon via IowaHawk’s twitter feed. That is all.

Tags:Austin, California, CalSTARS, Crime, Democrats, El Paso, environmentalism, Houston, Los Angeles, migration, Olympics, Palm Springs, Regulation, Texas, unions, Welfare State

Posted in Crime, Democrats, Regulation, Texas, unions, Welfare State | No Comments »

Friday, April 24th, 2015

Time for another Texas vs. California roundup:

The Manhattan Institute has a new report out discussing how California’s pension spending is starting to crowd out essential services. (Hat tip: Pension Tsunami.)

Austin is the number one city in the country for technology job creation.

Texas unemployment is down to 4.2%.

That’s the lowest unemployment rate since March of 2007.

Marin County Grand Jury:

Unfunded pension liabilities are a concern for county and city governments throughout California. Reviewing this problem in Marin County, the Grand Jury examined four public employers that participate in the Marin County Employees’ Retirement Association (MCERA): County of Marin, City of San Rafael, Novato Fire Protection District, and the Southern Marin Fire Protection District, hereafter collectively referred to as “Employer(s)”

The Grand Jury interviewed representatives of the County of Marin, sponsors of MCERA administered retirement plans, representatives of MCERA, and members of the various Employer governing boards and staff. It also consulted with actuaries, various citizen groups, and the Grand Jury’s independent court-appointed lawyers.

In so doing, the Grand Jury found that those Employers granted no less than thirty-eight pension enhancements from 2001- 2006, each of which appears to have violated disclosure requirements and fiscal responsibility requirements of the California Government Code.

(Hat tip: Pension Tsunami.)

The Marin Country lawyer: Nothing to see in this Grand Jury Report! Critics: Hey, aren’t you pulling down a cool $434,000 by “triple dipping” the existing system? (Ditto.)

Why does the University of California system have to hike tuition 28%? Simple: Pensions.

As with other areas of state and local budgets, a big factor is pension costs, which for UC have grown from $44 million in 2009-10 to $957 million in 2014-15. And the number of employees making more than $200,000 almost doubled from 2007-13, from 3,018 to 5,933.

While total UC employees rose 11 percent from October 2007 to October 2014, the group labeled “Senior Management Group and Management and Senior Personnel” jumped 32 percent.

(Hat tip: Pension Tsunami.)

Los Angeles Teacher’s Union gets a 10% pay hike over two years.

Like everything else associated with ObamaCare, covered California is screwed up.

BART wants a tax increase. This is my shocked face. (Hat tip: Pension Tsunami.)

And by my count, there are 157 BART employees who make more than $200,000 a year in salary and benefits…

California state senate committee votes to raise California’s minimum wage to $13 by 2017. If I were Gov. Greg Abbott, I’d be ready to start sending Texas relocation information packets to large California employers the minute this gets signed into law.

California-based Frederick’s of Hollywood files for bankruptcy. The retail lingerie business just isn’t what it used to be…

Torrence, California newspaper wins Pulitzer Prize for reporting on local school district corruption.

Priorities: Carson, California approves $1.7 billion for an NFL stadium even though they don’t have an NFL team to put in it.

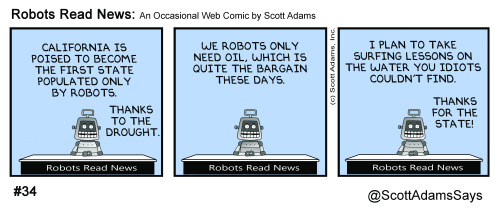

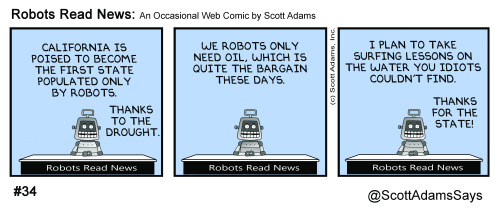

Dilbert’s Scott Adams weighs in on California’s drought:

Tags:Austin, California, Democrats, drought, Los Angeles, Los Angeles Unified School District, Marin County, ObamaCare, pension crisis, Texas, unemployment, unions, University of California, waste, Welfare State

Posted in Austin, Budget, Democrats, ObamaCare, unions, Waste and Fraud, Welfare State | No Comments »

Thursday, April 2nd, 2015

Time for another Texas vs. California roundup. The Texas House passed a budget, but I haven’t had a chance to look at it in any detail yet…

Unemployment rates in February: National average is 5.5%, Texas at 4.3%, California at 6.7%.

Even though hiring slowed to 7,100 new jobs in Texas in February, it was still the 53rd straight month of positive job creation, and Texas added 357,300 new jobs over the preceding 12 months.

A report from the Dallas Fed goes into more details.

California institutes mandatory water restrictions due to drought. California is indeed suffering a horrific drought, but it’s imposition of or acquiescence to idiotic environmental restrictions (see also: Delta Smelt) have made things much worse.

Some have proposed free market solutions to California’s water problems.

Workers comp abuse at LAPD/LAFD. (Hat tip: Pension Tsunami.)

Add Richmond, California to the list of cities that have radically underfunded their public employee retirement plans. “The shortfall of $446 million works out to about $4,150 for every city resident.” (Ditto.)

San Bernardino reveals its bankruptcy deal with CalPERS. (Hat tip: Pension Tsunami.)

Volokh the Younger examines the legal framework around the California rule (“not only that public employees are entitled to the pension they’ve accrued by their work so far, but also that they’re entitled to keep earning a pension (as long they continue in their job) according to rules that are at least as generous”), as well as its practical effects:

The California rule distorts what the salary/pension mix would otherwise be, given employer and employee preferences, and given the tax code as it is. Because underfunded pensions are a popular form of deficit spending, public employee compensation may already be too pension-heavy, and the rule makes it more so by freezing pensions in times of retrenchment. The incentive effects of the rule, given the political economy of government employment, may well exacerbate this tendency. And the possible theoretical reasons for preferring a pension-heavy mix don’t go very far in justifying this particular distortion.

California runs out of room on death row. Maybe they could subcontract to Texas…

Fresno’s deputy police chief busted on drug charges.

Tags:Alexander Volokh, California, Fresno, LAFD, LAPD, Los Angeles, pension crisis, Richmond (California), San Bernardino, Texas, unemployment, unions, Welfare State

Posted in Texas, unions, Welfare State | No Comments »

Thursday, March 26th, 2015

Time for another Texas vs. California roundup:

Forget all those snide liberal cracks about Texas’ public education system, since we have some of the highest graduation rates in the country.

“San Bernardino has defaulted on nearly $10 million in payments on its privately placed pension bond debt since it declared bankruptcy in 2012.”

The missed payments illustrate the trend among cities in bankruptcy to favor payments to pension funds over bondholder obligations, which has increased the hostility between creditors and municipalities.

San Bernardino declared last year that it intends under its bankruptcy exit plan to fully pay Calpers, its biggest creditor and America’s largest public pension fund with assets of $300 billion.

The city continues to pay its monthly dues to Calpers in full, but has paid nothing to its bondholders for nearly three years, according to the interest payment schedule on roughly $50 million of pension obligation bonds issued by San Bernardino in 2005.

If you’re a bank, a retirement fund, or a hedge fund, why on earth would you buy California municipal debt when there are safer alternatives? (Hat tip: Ace of Spades HQ Doom roundup.)

So how’s that San Francisco minimum wage law working out? Exactly like everyone who understands economics expected. “Some restaurants and grocery stores in Oakland’s Chinatown have closed after the city’s minimum wage was raised. Other small businesses there are not sure they are going to survive, since many depend on a thin profit margin and a high volume of sales.” Plus this: “Low-income minorities are often hardest hit by the unemployment that follows in the wake of minimum wage laws. The last year when the black unemployment rate was lower than the white unemployment rate was 1930, the last year before there was a federal minimum wage law.”

California’s Legislative Analyst’s Office suggests phasing out state health care for workers entirely.

California is dead last in spending transparency among the 50 states, with an F rating and a piddling score of 34. Texas ranks 13th with an A- and a score of 91. (Hat tip: Cal Watchdog.)

“North Texas gained an average of 360 net people per day from July 2013 to July 2014, a testament to the job-creating machine in the Lone Star state, according to the U.S. Census Bureau…North Texas and Houston were the only metropolitan areas to add more than 100,000 people during that one-year period.”

Just because California has some of the highest taxes in the nation doesn’t mean that the state’s Democratic legislature doesn’t want to add still more.

Meanwhile, the Texas Senate just passed a $4.6 billion tax cut.

California is rolling out more subsidies for Hollywood.

The Los Angeles Department of Water and Power not only has the highest employe costs in the country, it also ranks last in customer satisfaction. (Hat tip: Pension Tsunami.)

While Texas is certainly in much better shape than California on public employee pensions, things here are not entirely cloudless either. “The Texas Employee Retirement System is reporting unfunded liability of $14.5 billion in 2014, compared with liability of just $6.3 billion in 2013. By comparison, all of the state government’s general obligation debt as of 2013 was $15.3 billion. The Texas Law Enforcement and Custodial Officer Supplemental Retirement Plan is reporting unfunded liability of $673.1 million in 2014, compared with $306.7 million in 2013.”

Unlike California, Texas looks to get ahead of the curve on pension concerns with House Bill 2608, which restores control of pension funds to the local level by eliminating legislative approval for pension changes. I”nstead of locking up significant benefits in state statute, HB 2608 would allow city pension systems, like the Houston Firefighters’ Relief & Retirement Fund, to solve pension problems at the local level by changing benefit structures, if they so chose.”

“Support for the “bullet train” is ebbing across California, except, perhaps, in the Governor’s mansion.”

California raisin packer West Coast Growers files for Chapter 11.

American Spectrum Realty, a real estate investment management company that operates self-storage facilities under the 1st American Storage brand, has somehow managed to file for bankruptcy in both California and Texas. I think it’s safe to say that financial shenanigans are involved…

Lawsuit over misappropriated funds in a Napa Valley winery leads to a murder/suicide. It’s one of those stories that sounds too strange not to link to…

Tags:Budget, California, Crime, Economics, education, Los Angeles, minimum wage, Napa, Oakland, pension crisis, San Bernardino, San Francisco, Texas, unions, Welfare State

Posted in Budget, Crime, Democrats, Economics, Texas, unions, Welfare State | No Comments »