You know the problem with doing one of these roundups on the European Debt Crises? I can search for “Euro” just about anytime of the day and night on Google News and come up with a dozen things I could potentially include. So just consider this a Whitman’s European Despair Sampler of possible bad news, as there’s a lot more where this came from:

Posts Tagged ‘Portugal’

EuroDoom Roundup: Waiting for the Inevitable Greek Default

Monday, January 30th, 2012Slow Motion EuroZone Trainwreck Continues

Monday, December 19th, 2011It didn’t take long for cracks to start appearing among national politicians who are not nearly so sanguine over the prospect of Anschluss II as their counterparts in Brussels.

The French people are not wild about it either. But French politicians only pay slightly more attention to the French people than they do to the American government, which is to say: precious little.

The Portuguese threaten nuclear default.

Did the announcement calm markets elsewhere? Not so much:

Some of the world’s most powerful investment banks were downgraded by ratings agency Fitch as Germany’s cherished European fiscal compact appeared to be unraveling. The banks that were downgraded [Wednesday] night include US banks Bank of America and Goldman Sachs, Barclays and France’s BNP Paribas. Switzerland’s Credit Suisse and Germany’s Deutsche Bank were also cut.

Even France is in danger of a downgrade.

Of course, all this supposes that the new EuroPact will actually accomplish something. Fitch Ratings is not so sure. After warning of rating downgrades on “Belgium, Cyprus, Ireland, Italy, Slovenia and Spain,” they come to the bracing conclusion that “a ‘comprehensive solution’ to the eurozone crisis is technically and politically beyond reach.”

And now for the section of the roundup in which I quote whopping large chunks of Ambrose Evans-Pritchard on the whole thing.

First, the EU would like the UK to throw more money into the black hole. The UK is telling them to get stuffed:

Euro rage is reaching new heights over Britain’s latest outrage.

Our refusal to pony up a further €31bn we cannot afford, to prop up a monetary union that was created against our wishes and better judgment, and with the malevolent purpose of accelerating the great leap forward to a European state that is inherently undemocratic.

It is being presented as treachery, Anglo-Saxon perfidy, and the naked pursuit of national self-interest.

Let me just point out:

1) The UK never agreed to such a commitment in the first place. The line was written into the December 9 summit communiqué in an attempt to bounce Britain into handing over the money.

2) The UK does not consider the rescue machinery to be remotely credible as constructed.

3) The eurozone has the means to tackle its own debt crisis, if it is willing to use them. These include fiscal pooling and the mobilisation of the ECB.

As eurozone politicians never tire of reminding us, their aggregate debt levels are lower than those of the UK, US, or Japan. They are right. So get on with it and stop begging.

Euroland is of course entitled not to deploy eurobonds or the ECB if these mean a) a breach of the German constitution b) violate the ECB’s mandate. But that is entirely their choice. Both the Grundgesetz and the ECB mandate can be changed.

It was EMU members who created this dysfunctional currency. They are now trying to shift the consequences of their error onto others rather than taking the minimum steps necessary to fix the problem at root.

Second, his pointing out that the proposed treaty actually accomplishes very little:

The leaders of France and Germany have more or less bulldozed Britain out of the European Union for the sake of a treaty that offers absolutely no solution to the crisis at hand, or indeed any future crisis. It is EU institutional chair shuffling at its worst, with venom for good measure.

[snip]

And what for? All this upheaval for a mess of pottage, a flim-flam treaty? The deal is not a “lousy compromise”, said Angela Merkel. Well, actually that is exactly what it is for eurozone politicians searching for a breakthrough.

It tarts up the old Stability Pact without changing the substance (although there will be prior vetting of budgets). This “fiscal compact” is not going to make to make the slightest impression on global markets, and they are the judges who matter in this trial by fire.

Yes, there is more discipline for fiscal sinners, but without any transforming help. Even the old “Marshall Plan” of the July summit has bitten the dust.

There is no shared debt issuance, no fiscal transfers, no move to an EU Treasury, no banking licence for the ESM rescue fund, and no change in the mandate of the European Central Bank.

In short, there is no breakthrough of any kind that will convince Asian investors that this monetary union has viable governance or even a future.

Germany has kept the focus exclusively on fiscal deficits even though everybody must understand by now that this crisis was not caused by fiscal deficits (except in the case of Greece). Spain and Ireland were in surplus, and Italy had a primary surplus.

As Sir Mervyn King said last week, the disaster was caused by current account imbalances (Spain’s deficit, and Germany’s surplus), and by capital flows setting off private sector credit booms.

The Treaty proposals evade the core issue.

Ironically, the actual text of the new agreement has all sorts of things (like requiring a Balanced Budget Amendment to national constitutions) that, had it been in place and enforced 15 years ago might have prevented the situation in the first place. But if the nations of Europe had been capable of balancing their budgets, they wouldn’t have needed a Euro-fueled spending spree to keep their welfare states solvent in the first place.

For the PIIGS, growth is neither possible nor enough: “There is at this point no conceivable policy scenario which somehow makes Italy and Greece grow by as much as 2% a year for the next few years.”

Fed says no Euro bailout. But one might wonder at the firmness of their resolve. Especially since the head of the IMF says they need funds from outside the EU. Because who doesn’t love throwing good money after bad?

European bank walks are starting to turn into bank jogs.

Gold prices have plunged since the Euro treaty was announced. A sign the worst has passed? No, quite the opposite: Europe’s banks are selling their gold reserves in an attempt to stay solvent.

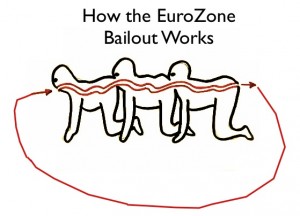

Let’s see if I’ve got this straight: EuroZone members, threatened by sovereign default on their bonds, are giving money backed by those same bonds to the IMF, which will use the money to prop up the EuroZone in order to prevent EuroZone countries from defaulting on their bonds. In order to help readers understand the genius of this maneuver, I have slightly altered a graphic from a recent movie to explain the concept:

(Hat tips: Insta, Ace, and The Corner, plus no doubt a few I’ve forgotten.)

Ten Days to a EuroZone Collapse?

Monday, November 28th, 2011So says a piece in the Financial Times, here excerpted from behind the paywall.

Things are moving very fast indeed on the Euro front:

From the beginning, the Brussels elites made it clear that, to adapt Abraham Lincoln, their paramount object was to save the Union. Never mind if that meant imposing epochal poverty and emigration on the southern members, and unprecedented tax rises on the northern. Never mind if it meant toppling the elected prime ministers of Italy and Greece and replacing them with Eurocrats (respectively a former European Commissioner and a former vice president of the European Central Bank — two perfect specimens of the people who caused the crisis in the first place). They were prepared to pay any price to keep the euro together — or, more precisely, to expect their peoples to pay, since EU employees are generally exempt from national taxation.

The only beneficiaries of the State’s assumption of [Anglo Irish Bank]’s liabilities are taxpayers in the countries whose banks were the reckless lenders to Anglo. Anglo, for all the guff at the time of the bank guarantee, had no systemic importance to the Irish economy. Irish taxpayers had no moral or other liability for its debts.

The sole reason for saving it was the ECB’s insistence that no euro zone bank should fail. Had Anglo failed, the costs would have been borne primarily by European banks and consequently by European taxpayers.

So the undertaking by the Irish State to stump up €47 billion to pay those private debts is an act of extreme (if extremely demented) euro-altruism. We are Europe’s ragged-trousered philanthropists, bailing out the euro with money we don’t have and that our European partners are kindly lending us at penal interest rates.

And this single act of insane generosity wipes out every red cent we’ve got from Europe since 1973.

[snip]

And for what? For less than nothing. For a moment of panic, a daft notion, a stupid indulgence in bluster and bravado. Some bleary-eyed fools decided, in the middle of the night, that they could bluff the markets by throwing all the chips we might ever have on to the table. It didn’t take long for the markets to realise that their hand contained nothing better than a pair of deuces.

But the gamble failed for Europe too. There might be some kind of (very expensive) pride in being able to say that little Ireland took the hit to save the euro zone, like the starry-eyed gal who takes a bullet for the outlaw in a corny western. But we saved nothing. All we managed to do was to buy the euro zone leaders more time in which to delude themselves that there was no real crisis.

More Greek Default Rumblings

Sunday, September 25th, 2011Actually, less rumblings than the roar of an approaching train. And since I temporarily seem to be ahead of the latest Ace of Spades Doom roundup, I’m going to try and give you a nice clear view of the coming crash.

“No longer a question of if, but when – that is the tone of discussions over Greece which has dominated the summit of finance ministers in Washington over the weekend.” Former Britain’s former finance minister Alistair Darling agrees, calling default “only a matter of time.”

The talk now is of how to put in a “firewall” to prevent the contagion of an inevitable Greek default from spreading throughout the European banking system.

The Euroskeptics have been completely vindicated:

Very rarely in political history has any faction or movement enjoyed such a complete and crushing victory as the Conservative Eurosceptics. The field is theirs. They were not merely right about the single currency, the greatest economic issue of our age — they were right for the right reasons. They foresaw with lucid, prophetic accuracy exactly how and why the euro would bring with it financial devastation and social collapse.

I think at this point UK residents should be feeling vrey glad indeed that they didn’t abandon the Pound for the Euro.

Bret Stephens talks about the long line of deceit and fraud that lead Europe to the current crises. “What is now happening in Europe isn’t so much a crisis as it is an exposure: a Madoff-type event rather than a Lehman one.”

Mark Steyn, using the ever popular music and political metaphor gambit, compares the breakup of the Eurozone with the breakup of R.E.M. while bringing the usual Steyn goodness: “Attempting to postpone the Club Med welfare junkies’ rendezvous with self-extinction will destabilize internal German politics (which always adds to the gaiety of nations).” And this:

As its own contribution to the end of the world as we know it, the Obama administration has just released a document called “Living Within Our Means and Investing in the Future: The President’s Plan for Economic Growth and Deficit Reduction.” If you’re curious about the first part of the title — “Living Within Our Means” — Veronique de Rugy pointed out at National Review that under this plan debt held by the public will grow from just over $10 trillion to $17.7 trillion by 2021. In other words, the president’s definition of “Living Within Our Means” is to burn through the equivalent of the entire German, French, and British economies in new debt between now and the end of the decade. You can try this yourself next time your bank manager politely suggests you should try “living within your means”: Tell him you’ve got an ingenious plan to get your spending under control by near doubling your present debt in the course of a mere decade. He’s sure to be impressed.

Germany is near the limit of their willingness to bail out Greece.

There may even be a taxpayer revolt brewing in the Aegean.

And if the other PIIGS are doing better than Greece, it is only a matter of degrees: “Italy is the new Lebanon, Portugal the new Venezuela, Spain the new Vietnam, Ireland the new Argentina and nothing is more risky than Greece, according to today’s credit default swap market.”

But it’s not just Greece and Europe that are hitting the wall. China’s housing bubble may finally be bursting. Worse still: “growth in China may be zero [and] China has ‘European kind of numbers’ when it comes to debt.”

And the Chinese housing bubble isn’t just affecting China. It’s also affecting Canada.

And at least one observer has drawn parallels to a certain hopemonger currently residing in the White House:

Obama has no intention of really solving the debt crisis. And that brings us back to Greece. That government has been doing the same thing for a decade and the chickens have now come home to roost. Greece’s debt is 150 percent of its Gross Domestic Product. Our debt has just reached 100 percent of GDP and the debt is accumulating faster than it ever has. If we were looking out the windshield down the road, we could see the crash that’s just up around the bend.

But rather than put on the brakes, the president has chosen to pick a fight with the other passengers in the car he is driving. Talk about distracted driving! He is gambling that this fight will convince the passengers to let him stay behind the wheel for another four years. But we certainly can’t wait that long. He’s turned up the radio in hopes we won’t hear the ambulance sirens.

It looks like its going to be another rough week for world markets…

More on the Greek Euro U.S. World Debt Crises

Monday, August 8th, 2011

The Moody’s downgrade of Portuguese debt link was a quick blipvert for a current event, but I wanted to do a somewhat longer roundup of pieces on the Euro debt crises and the potential for more shocks down the line. Unfortunately for both me and pretty much everyone in the world, things have been moving too fast to get a good handle on before the next crisis erupts. And after the Obama downgrade, things are moving faster than ever.

Which is pretty fast indeed. The Eurocrats, in best shoot-the-messenger style, have decided to start ignoring bond rating services in the wake of Moody’s downgrade of Portugal. If that weren’t enough, Italian police raided the offices of Standard & Poors following their downgrade of Italian credit ratings.

How did Greece get in the position of being the first domino to fall in the Euro crisis? The election of Andreas Papandreou as Prime Minister helped start the ball rolling:

On October 18, 1981, a charismatic academic with rather limited government experience and with a one-word slogan, “Change,” was elected prime minister of Greece. His name was Andreas Papandreou. Greeks may now wish that 30 years ago they had had a Tea Party movement. Things could have turned out differently.

Thirty years ago, Greece was in an enviable position on the matter of national debt, with its debt just 28.6 percent of GDP. Few advanced countries can manage that kind of debt-to-GDP ratio. By the end of Papandreou’s first term in office, that ratio had nearly doubled, with debt at 54.7 percent of GDP. By the end of his second term, the figure was in the mid 80s.

But that was just the first step. The second was letting Greece join the Eurozone in 1999 despite their patent unwillingness to get their financial house in order. “Repeatedly, and for 30 years, the Greeks have played Europe like a harp.”

June’s European Union summit illustrated the chaos perfectly: a last-minute deal with Athens to raise the Greek income-tax threshold and increase levies on heating oil was hailed as a breakthrough even though everyone involved knows that this will buy, at best, a few months’ respite from Greece’s creditors. Thus are deck chairs rearranged, as the Greek pleasure yacht (classified, of course, as a fishing boat to escape taxes) sinks below the waves. The markets duly marked up the five-year probability of a Greek default to 80 percent.

The advice to Margaret Thatcher decades ago from the Foreign Office mandarin charged with European policy was clear: Greece was unfit to join what was then known as the European Community. The backward, chaotic archipelago would be an enduring drain on European coffers. Not only that: once through the door, Athens would bring nothing but trouble.

That foolish decision to allow Greece to join lies at the root of the crisis engulfing the euro zone and lapping America’s shores. Consciously, among its pampered political elite — and subliminally in society at large — Greeks got the idea that being Europe’s backward, indulged delinquent was a highly profitable game.

A piece quoting and summarizing two different Financial Times pieces (behind their paywall, alas), both of which predict a bad end to the Greek debt crises, albeit partially from differing reasons.

Andrew Butter makes parallels with Weimar Germany. Don’t agree with everything the author says, although you I do admire this sentence: “It’s getting harder to do the austerity thing these days, now that it’s considered politically incorrect to shoot at rioters with live ammunition, which wasn’t an issue in 1923.”

So if pretty much everyone agrees that Greek default is inevitable, why keep shuffling the deck chairs? Simple: So they can stick taxpayers with the bill. “Foreign financial institutions currently own 42 per cent of Greek debts, and foreign governments 26 per cent, the rest being owed domestically. By 2014, those figures will be 12 per cent and 64 per cent respectively. European banks, in other words, will have shuffled off their losses onto European taxpayers.”

So an effort to shield Euroelites from the worst effects of the debt crisis may end up destroying the Euro entirely.

Given the already considerable length of this post, I doubt I have time to address some of the ramifications of the Obama Downgrade, so that will have to wait for another post…

Portugal’s Bonds Downgraded to Junk

Tuesday, July 5th, 2011Between strikes in Greece, constitutional challenges to the Greek bailout in Germany, and other agencies rating the latest Greek bailout as tantamount to default, efforts to prevent a Euro-default contagion may fail sooner rather than later…