The Fed goes Volcker, more Welcome Back Carter cosplay, Big Yellow moves to Texas, and Florida Man makes a run for the ocean.

FYI, Blue Host has been acting weird today, giving errors when you tried to save, even though everything appears to be there upon reloading. (Shrugs.)

- Oil was one of the primary causes of the 1970s inflation and everyone remembers the oil crisis. During the decade, oil ran all the way from $2 to $39. However, the flipside to this story is that with a lag, high oil prices will eventually incentivize production. The issue was that the US specifically disincentivized US producers and importers. Ronald Reagan signed an Executive Order in January of 1981 to eliminate oil price controls and then removed Jimmy Carter’s idiotic Windfall Profits Tax a few years later. As expected, global production expanded rapidly and with the removal of price controls, that production flooded into the US. By the middle of the decade, despite repeated production cuts by OPEC, there was a global glut of oil and by 1985, oil had collapsed all the way to $7. It wasn’t interest rates that made oil decline, it was government policy on the deregulation side, along with rapid production increases from non-OPEC countries.

- President Reagan’s Economic Recovery Tax Act was signed into law in August of 1981, designed to reduce tax rates and incentivize investment by rewarding risk-taking by businesses. In particular, the Accelerated Cost Recovery System served to accelerate depreciation, reducing taxes for those that invested in productive capacity. Once again, government policy, not interest rates led to an increase in investment and ultimately supply, helping to tame inflation.

- It wasn’t just Reagan working on de-regulation; The Staggers Act of October 1980, deregulated the railroads, The Motor Carrier Act of July 1980, deregulated the trucking industry, and the Airline Deregulation Act of October 1978 effectively deregulated transport industries. The net effect was dramatic price competition, better ability to invest and innovate, and the ability to eliminate unprofitable business that was funded by profitable business. Almost immediately after passage, pricing for transport services collapsed and the ease of transporting goods expanded.

- Organized labor was also dealt a near-fatal blow when Reagan fired the air traffic controllers in August of 1981. This may have reduced the wages for a generation of middle-class workers, but it sure wasn’t inflationary. It also accelerated the decline of unions which had already peaked out as a percentage of workers. More importantly, it reduced the militancy of unions and took the teeth out of their ability to disrupt businesses, leading to better efficiency and lower costs for consumers.

- At the same time, when it comes to macroeconomics, demographics equals destiny. In this case, Volcker simply got lucky. Think of the Baby Boom generation, the last of whom was born in 1964. By 1982, these last Boomers hit 18 and started joining the workforce. The eldest Baby Boomers, born in 1946, were already 36 by then. Look at the massive increase in workers starting in the late 1970s and into the 1980s, which tamped down wages and tamed inflation—especially as female participation in the workforce expanded dramatically. This added labor slowed a key component of the inflation.

The Biden Administration looks capable of pursuing none of those policies, and the Baby Boomers are starting to retire…

For weird reasons, some people, many people, imagined that governments could just shut down an economy and turn it back on without consequence. And yet here we are.

Historians of the future, if there are any intelligent ones among them, will surely be aghast at our astounding ignorance. Congress enacted decades of spending in just two years and figured it would be fine. The printing presses at the Fed ran at full tilt. No one cared to do anything about the trade snarls or supply-chain breakages. And here we are.

Our elites had two years to fix this unfolding disaster. They did nothing. Now we face terrible, grim, grueling, exploitative inflation, at the same time we are plunging into recession again, and people sit around wondering what the heck happened.

I will tell you what happened: the ruling class destroyed the world we knew. It happened right before our eyes. And here we are.

Last week, the stock market reeled on the news that the European Central Bank will attempt to do something about the inflation wrecking markets. So of course the financial markets panicked like an addict who can’t find his next hit of heroin. This week already began with more of the same, for fear that the Fed will be forced to rein in its easy-money policy event further. Maybe, maybe not; but recession appears impending regardless.

The bad news is everywhere.

The polling error for the 2020 election was roughly 4% nationwide, the largest in the last 40 years.

Fast-forward to today. Inflation is 8+ percent, the price of food and gasoline is way up, crime is up, there is a nationwide shortage of baby formula, and don’t get me started on the border crisis. Yet Joe Biden’s job approval is close to 40% positive. That means almost four out of every ten Americans think Joe is doing a good job if you believe the RealClearPolitics average. And I don’t.

Snip.

If the polls are overestimating approval numbers for Biden and other Democrats, how bad is it? The political climate today is different since the 2020 election, but the Democrat poll bias seems intact, which was 4% nationwide. Since nonresponse bias, 4%, and registered voter bias, 2.6%, should be mutually exclusive, we can add them together. This gives us a total Democrat bias of roughly 6.5%

What does this mean? Until pollsters switch to sampling likely voters right before the election, you can subtract a solid 6 percent from Joe Biden’s approval numbers. And if nothing changes before the election, any Democrat who leads by 3 percent or less is likely to lose.

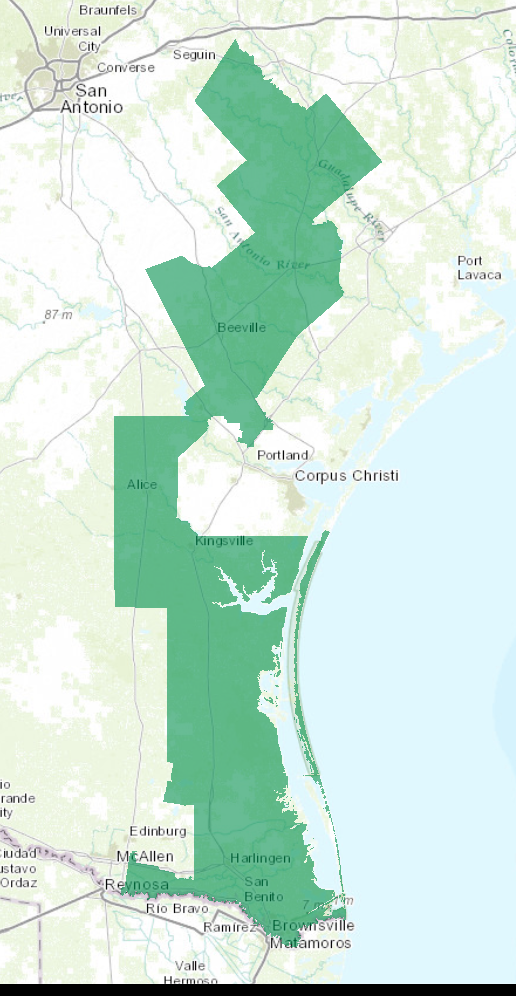

Texas Attorney General Ken Paxton is enjoying a victory against a Biden administration policy that has allowed illegal aliens to cross the southern border without consequence.

In 2021, President Joe Biden’s Department of Homeland Security issued a rule giving immigration law enforcement officials the power to decide whether or not to detain illegal aliens who attempt to cross the border (in contradiction to federal law, which says they must all be detained).

This policy caught the attention of Texas Attorney General Paxton and Louisiana Attorney General Jeff Landry, who sued to stop the rule change, arguing that Biden was violating federal law when refusing to take custody of criminal migrants.

Paxton bashed President Biden, arguing that the policy was contrary to federal law and was instituted without following the proper procedure. Over a year since the original lawsuit was filed, a federal judge issued a ruling against the Biden administration on Friday.

Federal District Judge Drew Tipton said in his decision that the rule was “an implausible construction of federal law that flies in the face of the limitations imposed by Congress.” Tipton added, “Whatever the outer limits of the authority, the executive branch does not have the authority to change the law.”

After a legal fight lasting almost a year, Texas judges ruled a final judgment banning Biden’s detention-discretion rule.

(Hat tip: Stephen Green at Instapundit.)

Bucket Swimming #dogs #funny #pets pic.twitter.com/dW43JIK6LJ

— Baby Animals (@BBAnimals) June 15, 2022