It didn’t take long for cracks to start appearing among national politicians who are not nearly so sanguine over the prospect of Anschluss II as their counterparts in Brussels.

The French people are not wild about it either. But French politicians only pay slightly more attention to the French people than they do to the American government, which is to say: precious little.

The Portuguese threaten nuclear default.

Did the announcement calm markets elsewhere? Not so much:

Some of the world’s most powerful investment banks were downgraded by ratings agency Fitch as Germany’s cherished European fiscal compact appeared to be unraveling. The banks that were downgraded [Wednesday] night include US banks Bank of America and Goldman Sachs, Barclays and France’s BNP Paribas. Switzerland’s Credit Suisse and Germany’s Deutsche Bank were also cut.

Even France is in danger of a downgrade.

Of course, all this supposes that the new EuroPact will actually accomplish something. Fitch Ratings is not so sure. After warning of rating downgrades on “Belgium, Cyprus, Ireland, Italy, Slovenia and Spain,” they come to the bracing conclusion that “a ‘comprehensive solution’ to the eurozone crisis is technically and politically beyond reach.”

And now for the section of the roundup in which I quote whopping large chunks of Ambrose Evans-Pritchard on the whole thing.

First, the EU would like the UK to throw more money into the black hole. The UK is telling them to get stuffed:

Euro rage is reaching new heights over Britain’s latest outrage.

Our refusal to pony up a further €31bn we cannot afford, to prop up a monetary union that was created against our wishes and better judgment, and with the malevolent purpose of accelerating the great leap forward to a European state that is inherently undemocratic.

It is being presented as treachery, Anglo-Saxon perfidy, and the naked pursuit of national self-interest.

Let me just point out:

1) The UK never agreed to such a commitment in the first place. The line was written into the December 9 summit communiqué in an attempt to bounce Britain into handing over the money.

2) The UK does not consider the rescue machinery to be remotely credible as constructed.

3) The eurozone has the means to tackle its own debt crisis, if it is willing to use them. These include fiscal pooling and the mobilisation of the ECB.

As eurozone politicians never tire of reminding us, their aggregate debt levels are lower than those of the UK, US, or Japan. They are right. So get on with it and stop begging.

Euroland is of course entitled not to deploy eurobonds or the ECB if these mean a) a breach of the German constitution b) violate the ECB’s mandate. But that is entirely their choice. Both the Grundgesetz and the ECB mandate can be changed.

It was EMU members who created this dysfunctional currency. They are now trying to shift the consequences of their error onto others rather than taking the minimum steps necessary to fix the problem at root.

Second, his pointing out that the proposed treaty actually accomplishes very little:

The leaders of France and Germany have more or less bulldozed Britain out of the European Union for the sake of a treaty that offers absolutely no solution to the crisis at hand, or indeed any future crisis. It is EU institutional chair shuffling at its worst, with venom for good measure.

[snip]

And what for? All this upheaval for a mess of pottage, a flim-flam treaty? The deal is not a “lousy compromise”, said Angela Merkel. Well, actually that is exactly what it is for eurozone politicians searching for a breakthrough.

It tarts up the old Stability Pact without changing the substance (although there will be prior vetting of budgets). This “fiscal compact” is not going to make to make the slightest impression on global markets, and they are the judges who matter in this trial by fire.

Yes, there is more discipline for fiscal sinners, but without any transforming help. Even the old “Marshall Plan” of the July summit has bitten the dust.

There is no shared debt issuance, no fiscal transfers, no move to an EU Treasury, no banking licence for the ESM rescue fund, and no change in the mandate of the European Central Bank.

In short, there is no breakthrough of any kind that will convince Asian investors that this monetary union has viable governance or even a future.

Germany has kept the focus exclusively on fiscal deficits even though everybody must understand by now that this crisis was not caused by fiscal deficits (except in the case of Greece). Spain and Ireland were in surplus, and Italy had a primary surplus.

As Sir Mervyn King said last week, the disaster was caused by current account imbalances (Spain’s deficit, and Germany’s surplus), and by capital flows setting off private sector credit booms.

The Treaty proposals evade the core issue.

Ironically, the actual text of the new agreement has all sorts of things (like requiring a Balanced Budget Amendment to national constitutions) that, had it been in place and enforced 15 years ago might have prevented the situation in the first place. But if the nations of Europe had been capable of balancing their budgets, they wouldn’t have needed a Euro-fueled spending spree to keep their welfare states solvent in the first place.

For the PIIGS, growth is neither possible nor enough: “There is at this point no conceivable policy scenario which somehow makes Italy and Greece grow by as much as 2% a year for the next few years.”

Fed says no Euro bailout. But one might wonder at the firmness of their resolve. Especially since the head of the IMF says they need funds from outside the EU. Because who doesn’t love throwing good money after bad?

European bank walks are starting to turn into bank jogs.

Gold prices have plunged since the Euro treaty was announced. A sign the worst has passed? No, quite the opposite: Europe’s banks are selling their gold reserves in an attempt to stay solvent.

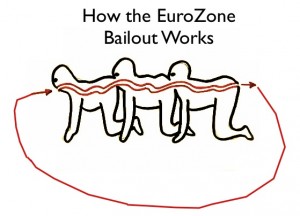

Let’s see if I’ve got this straight: EuroZone members, threatened by sovereign default on their bonds, are giving money backed by those same bonds to the IMF, which will use the money to prop up the EuroZone in order to prevent EuroZone countries from defaulting on their bonds. In order to help readers understand the genius of this maneuver, I have slightly altered a graphic from a recent movie to explain the concept:

(Hat tips: Insta, Ace, and The Corner, plus no doubt a few I’ve forgotten.)