Another week, another Hillary Clinton corruption roundup. Remember, this is only what I had time to compile among all my other work, blogging, writing, etc. Cataloging Clinton corruption could easily be a full time job…

This Week in Clinton Corruption for September 1, 2016

September 1st, 2016What a Dick

August 31st, 2016Anthony Weiner got caught sexting pics of his crotch yet again, this time with his child lying next to him. So his wife, Hillary Clinton’s all-everything functionary Huma Abedin, announced they were separating.

Now, I don’t want to kick a guy when he’s down, so let us pass over this family tragedy in respectful sihahahahahha!

Sorry, couldn’t type that and keep a straight face. Weiner deserves not only all the criticism and cheap dick puns he’s getting, he deserves a never-ending stream of cock punches to go with it.

So let’s roast this Weiner.

How freaking stupid do you have to be to get caught doing the same stupid, sleazy thing you’ve already been caught doing for a third time? That’s like a thug repeatedly robbing the same convenience he’s already robbed before, despite the fact his wanted posted is hanging behind the counter. Each incident has been more sad and squalid than the last. Carlos Danger and Sydney Leathers at least sound like they could have come from one of those James Bond porno parody novels from the 60s; his latest boner is like something from one of those trashy reality shows where two cheating spouses scream at each other in front of a whooping audience. At this point, you have to assume Weiner’s getting off on the humiliation.

He also finally deleted his Twitter account, which is like closing the barn door five years after the cow has burned down not only Chicago, but every other township in a 200 mile radius.

And then there’s his wife. Maybe she welcomed the latest scandal as a chance to stop answering questions about her familial Muslim Brotherhood connections and how she helped aid and abet her patron’s felonies.

“She may not know what’s best for herself, but she apparently knows what’s best for Hillary Clinton. I mean, she’s in line, she’s chief aide now. She’s presumably gonna be Hillary’s chief of staff. But she has not been chief of her husband’s staff, obviously.”

What is it about the Clintons that makes them attract such a deranged freakshow of damaged courtiers and cronies to their orbit? It’s a shambling parade of the morally deformed and emotionally crippled. And there’s a good chance they’ll pitch their tent on the White House lawn come January…

Texas vs. California Update for August 30, 2016

August 30th, 2016- Texas:

Texas’s fiscal policy is very good. It is a fiscally decentralized state, with local taxes at about 4.5 percent of personal income, above the national average, and state taxes at about 3.6 percent of income, well below the national average. However, Texans don’t have much choice of local government, with only 0.36 jurisdictions per 100 square miles. State and local debt is above average (with the biggest problem being local debt burdens), at 23.1 percent of income, but it has come down slightly since FY 2011. Government subsidies are below average. Public employment has fallen significantly below average, at 11.8 percent of private employment.

Texas’s land-use freedom keeps housing prices down. It also has a regulatory taking compensation law, but it only applies to state government. The renewable portfolio standard has not been raised in years. Texas is our top state for labor-market freedom. Workers’ compensation coverage is optional for employers; most employees are covered, but not all. The state has a right-to-work law, no minimum wage, and a federally consistent anti-discrimination law. Cable and telecommunications have been liberalized. However, health insurance mandates were quite high as of 2010, the last available date. The extent of occupational licensing is high, but the state recently enacted a sunrise review requirement for new licensure proposals. Time will tell whether it is at all effective. Nurse practitioners enjoy no freedom of independent practice at all. Texas has few cronyist entry and price regulations, but it does have a price-gouging law, and Tesla’s direct sales model is still illegal. The civil liability system used to be terrible, but now it is merely below average. The state abolished joint and several liability in 2003, but it could do more to cap punitive damages and end parties’ role in judicial elections.

- California:

Although it has long been significantly freer on personal issues than the national average, California has also long been one of the lowest-scoring states on economic freedom.

Despite Proposition 13, California is one of the highest-taxed states in the country. Excluding severance and motor fuel taxes, California’s combined state and local tax collections were 10.8 percent of personal income. Moreover, because of the infamous Serrano decision on school funding, California is a fiscally centralized state. Local taxes are about average nationally, while state taxes are well above average. Government debt is high, at 22.8 percent of personal income. The state subsidizes business at a high rate (0.16 percent of the state economy). However, government employment is lower than the national average.

Regulatory policy is even more of a problem for the state than fiscal policy. California is one of the worst states on land-use freedom. Some cities have rent control, new housing supply is tightly restricted in the coastal areas, and eminent domain reform has been nugatory. Labor law is anti-employment, with no right-to-work law, high minimum wages, strict workers’ comp mandates, mandated short-term disability insurance, and a stricter-than-federal anti-discrimination law. Occupational licensing is extensive and strict, especially in construction trades. It is tied for worst in nursing practice freedom. The state’s mandatory cancer labeling law (Proposition 65) has significant economic costs. It is one of the worst states for consumer freedom of choice in homeowner’s and automobile insurance.

(Hat tip: Pension Tsunami.)

California has been bleeding people to other states for more than two decades. Even after the state’s “comeback,” net domestic out-migration since 2010 has exceeded 250,000. Moreover, the latest Internal Revenue Service migration data, for 2013-2014, does not support the view that those who leave are so dominated by the flight of younger and poorer people.

Of course, younger people tend to move more than older people, and people seeking better job opportunities are more likely to move than those who have made it. But, according to the IRS, nearly 60,000 more Californians left the state than moved in between 2013 and 2014. In each of the seven income categories and each of the five age categories, the IRS found that California lost net domestic migrants.

Nor, viewed over the long term, is California getting smarter than its rivals. Since 2000, California’s cache of 25- to 34-year-olds with college, postgraduate and professional degrees grew by 36 percent, below the national average of 42 percent, and Texas’ 47 percent. If we look at metropolitan regions, the growth of 25- to 34-year-olds with college degrees since 2000 has been more than 1.5 to nearly 3 times as fast in Houston and Austin as in Silicon Valley, Los Angeles, or San Francisco. Even New York, with its high costs, is doing better.

(Hat tip: Instapundit, who also notes “I remember talking to the Investor’s Business Daily folks a few years ago — they were headquartered in Marina Del Rey, a lovely place but one where they were constantly visited by inspectors, tax people, etc., all posing problems. When they opened an office in Texas, the state and local government people were all ‘tell us if we can help you.’ Very different experience.”)

Seen as a national leader in the classroom during the 1950s and 1960s, the country’s largest state is today a laggard, competing with the likes of Mississippi and Washington, D.C., at the bottom of national rankings. The Golden State’s education tailspin has been blamed on everything from class sizes to the property-tax restrictions enforced by Proposition 13 to an influx of Spanish-speaking students. But no portrait of the system’s downfall would be complete without a depiction of the CTA, a political behemoth that blocks meaningful education reform, protects failing and even criminal educators, and inflates teacher pay and benefits to unsustainable levels.

Also this:

According to figures from the California Fair Political Practices Commission (a public institution) in 2010, the CTA had spent more than $210 million over the previous decade on political campaigning—more than any other donor in the state. In fact, the CTA outspent the pharmaceutical industry, the oil industry, and the tobacco industry combined.

California concluded its most recent cap-and-trade program auction last week. Out of 44,268,323 metric tons of carbon dioxide credits offered for sale by the state Air Resources Board, only 660,560 were sold, 1.5 percent of the total, raising a paltry $8.4 million out of a hoped-for $620 million. Last May’s auction was almost as bad, raising $10 million out of an anticipated $500 million.

California’s carbon dioxide cap-and-trade auction program was expected to bring in more than $2 billion in the current fiscal year that ends June 30, 2017, a quarter of which is earmarked for the high-speed rail project narrowly approved by voters in a 2008 ballot initiative. As a hedge against uncertainty, a $500 million reserve was built into the cap-and-trade budget. But, with the August auction falling 98.5 percent short, the entire reserve was consumed in the first of four auctions for the fiscal year.

It gets better:

In the meantime, the High-Speed Rail project, currently promised to cost “only” $68 billion to run from the Bay Area some 400 miles south to Los Angeles may be looking at $50 billion in overruns. To fund the costly train, which was sold to voters as not costing a dime in new taxes, the expected revenue stream from cap-and-trade has been securitized, putting the state on the hook to Wall Street for billions in construction money advanced on the promise of future cap-and-trade revenue.

Tiny Post on Florida’s Elections Tomorrow

August 29th, 2016You can be forgiven for thinking (as I did) that the primary season was over, but actually Florida has a primary election tomorrow, August 30.

I mainly mention this so I can talk about how I got not one, not two, but three flyers for Democratic House candidate Annette Taddeo, addressed to people who haven’t lived in this house for 12 years. That’s some might fine list maintenance, Women’s Vote Project (aka Emily’s List).

Also this: “Republican candidate for Florida House District 86, Laurel Bennett, was a bit shocked over the weekend when she discovered that a local West Palm Beach NBC affiliate, WPTV, reported that she had lost a race even though votes hadn’t been cast yet.”

Federal Judge to Gun-Banning UT Professors: REJECTED

August 29th, 2016In case you missed it, a lawsuit attempting to block the implementation of campus carry has been rejected by a federal judge:

A federal judge has denied three University of Texas at Austin professors’ initial attempt to keep guns out of their classrooms under the state’s campus carry law.

U.S. District Judge Lee Yeakel ruled that the professors, who had sought a preliminary injunction to block implementation of the law, had failed to establish their likelihood for success. UT students resume classes on Wednesday, and the professors’ case will continue to work its way through the court while the law remains in effect.

The professors, Jennifer Lynn Glass, Lisa Moore and Mia Carter, filed their lawsuit against the university and the attorney general’s office. In the suit, the professors said the possibility of guns on campus could stifle class discussion in their courses, which touch on emotional issues like gay rights and abortion. They argued that was a violation of students’ First Amendment right to free speech.

From the text of the decision:

The court concludes at this stage in the proceedings that requiring public universities to allow licensed individuals to carry concealed handguns is a basis for the Campus Carry Law that bears a debatably rational relationship to the conceivable legitimate governmental end of enabling individuals to defend themselves.

Also:

It appears to the court that neither the Texas Legislature nor the Board of Regents has overstepped its legitimate power to determine where a licensed individual may carry a concealed handgun in an academic setting. The court concludes that Plaintiffs have failed to establish a substantial likelihood of success on their equal-protection claim under the Fourteenth Amendment.

IV. CONCLUSION

Because Plaintiffs at this time have failed to establish a substantial likelihood of ultimate success on the merits of their asserted claims, their request for immediate relief must fail. The court therefore need not and does not reach the remaining requirements for granting a preliminary injunction. Bluefleld, 577 F.3d at 253 (“[A] preliminary injunction is an extraordinary remedy which should not be granted unless the party seeking it has ‘clearly carried the burden of persuasion’ on all four requirements.”). Accordingly,IT IS ORDERED that Plaintiffs’ Application for Preliminary Injunction (Clerk’s Doc. No. 20) is DENIED.

Score one for civil rights and the rule of law over irrational hopolophobia.

LinkSwarm for August 26, 2016

August 26th, 2016Welcome to another Friday LinkSwarm! We’re just weeks away from The Burning Time giving way to The Season of Football.

Some links:

This Week in Clinton Corruption

August 25th, 2016Every week brings new evidence of Hillary Clinton’s corruption and proof she lied about her insecure, homebrew email server. So naturally the media is focused on something some athlete may or may not have done in Rio.

Now on to this week’s Clinton Corruption:

(Washington, DC) – Judicial Watch today released 725 pages of new State Department documents, including previously unreleased email exchanges in which former Hillary Clinton’s top aide Huma Abedin provided influential Clinton Foundation donors special, expedited access to the secretary of state. In many instances, the preferential treatment provided to donors was at the specific request of Clinton Foundation executive Douglas Band.

The new documents included 20 Hillary Clinton email exchanges not previously turned over to the State Department, bringing the known total to date to 191 of new Clinton emails (not part of the 55,000 pages of emails that Clinton turned over to the State Department). These records further appear to contradict statements by Clinton that, “as far as she knew,” all of her government emails were turned over to the State Department.

The Abedin emails reveal that the longtime Clinton aide apparently served as a conduit between Clinton Foundation donors and Hillary Clinton while Clinton served as secretary of state. In more than a dozen email exchanges, Abedin provided expedited, direct access to Clinton for donors who had contributed from $25,000 to $10 million to the Clinton Foundation. In many instances, Clinton Foundation top executive Doug Band, who worked with the Foundation throughout Hillary Clinton’s tenure at State, coordinated closely with Abedin. In Abedin’s June deposition to Judicial Watch, she conceded that part of her job at the State Department was taking care of “Clinton family matters.”

Included among the Abedin-Band emails is an exchange revealing that when Crown Prince Salman of Bahrain requested a meeting with Secretary of State Clinton, he was forced to go through the Clinton Foundation for an appointment. Abedin advised Band that when she went through “normal channels” at State, Clinton declined to meet. After Band intervened, however, the meeting was set up within forty-eight hours. According to the Clinton Foundation website, in 2005, Salman committed to establishing the Crown Prince’s International Scholarship Program (CPISP) for the Clinton Global Initiative. And by 2010, it had contributed $32 million to CGI. The Kingdom of Bahrain reportedly gave between $50,000 and $100,000 to the Clinton Foundation. And Bahrain Petroleum also gave an additional $25,000 to $50,000.

Dallas Pension Fund Near Insolvenacy Thanks To Risky Investments

August 24th, 2016Dallas Police and Fire pension fund are near insolvency thanks to shady real estate deals:

The Dallas Police & Fire Pension (DPFP), which covers nearly 10,000 police and firefighters, is on the verge of collapse as its board and the City of Dallas struggle to pitch benefit cuts to save the plan from complete failure. According the the National Real Estate Investor, DPFP was once applauded for it’s “diverse investment portfolio” but turns out it may have all been a fraud as the pension’s former real estate investment manager, CDK Realy Advisors, was raided by the FBI in April 2016 and the fund was subsequently forced to mark down their entire real estate book by 32%. Guess it’s pretty easy to generate good returns if you manage a book of illiquid assets that can be marked at your “discretion”.

To provide a little background, per the Dallas Morning News, Richard Tettamant served as the DPFP’s administrator for a couple of decades right up until he was forced out in June 2014. Starting in 2005, Tettamant oversaw a plan to “diversify” the pension into “hard assets” and away from the “risky” stock market…because there’s no risk if you don’t have to mark your book every day. By the time the “diversification” was complete, Tettamant had invested half of the DPFP’s assets in, effectively, the housing bubble. Investments included a $200mm luxury apartment building in Dallas, luxury Hawaiian homes, a tract of undeveloped land in the Arizona desert, Uruguayan timber, the American Idol production company and a resort in Napa.

Despite huge exposure to bubbly 2005/2006 vintage real estate investments, DPFP assets “performed” remarkably well throughout the “great recession.” But as it turns out, Tettamant’s “performance” was only as good as the illiquidity of his investments. We guess returns are easier to come by when you invest your whole book in illiquid, private assets and have “discretion” over how they’re valued.

In 2015, after Tettamant’s ouster, $600mm of DPFP real estate assets were transferred to new managers away from the fund’s prior real estate manager, CDK Realty Advisors. Turns out the new managers were not “comfortable” with CDK’s asset valuations and the mark downs started. According to the Dallas Morning News, one such questionable real estate investment involved a piece of undeveloped land in the Arizona desert near Tucson which was purchased for $27mm in 2006 and subsequently sold in 2014 for $7.5mm.

It gets better: “Then the plot thickened when, in April 2016, according the Dallas Morning News, FBI raided the offices of the pension’s former investment manager, CDK Realty Advisors.”

Also: “And of course the typical pension ponzi, whereby in order to stay afloat the plan is paying out $2.11 for every $1.00 it collects from members and the City of Dallas effectively borrowing from assets reserved to cover future liabilities (which are likely impaired) to cover current claims in full.”

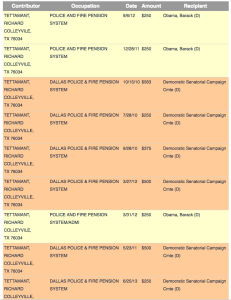

Want to guess which political party Richard Tettamant was affiliated with?

Go ahead. Guess.

(Hat tip: Jack Dean of Pension Tsunami.)